Forget paying interest. What if a lender paid YOU to borrow cash? At first glance, negative interest rates seem a little counterintuitive. After all, why would a lender be willing to pay someone to borrow their money? However negative interest rates are more common than you think and can impact your portfolio in all kinds of ways.

How do negative interest rates work? Who benefits (or doesn’t)? The relationship between negative interest rates, inflation, and bonds is often poorly understood, but incredibly important for understanding your investments.

What Is a Negative Interest Rate?

Negative rates are meant to encourage borrowing and lending. In a negative interest rate environment, instead of paying interest to lenders, borrowers are credited interest instead. This unusual scenario generally occurs during a deep economic recession or during deflationary periods, when consumers hold too much money instead of spending as they wait for a turnaround in the economy.

Who Determines Interest Rates?

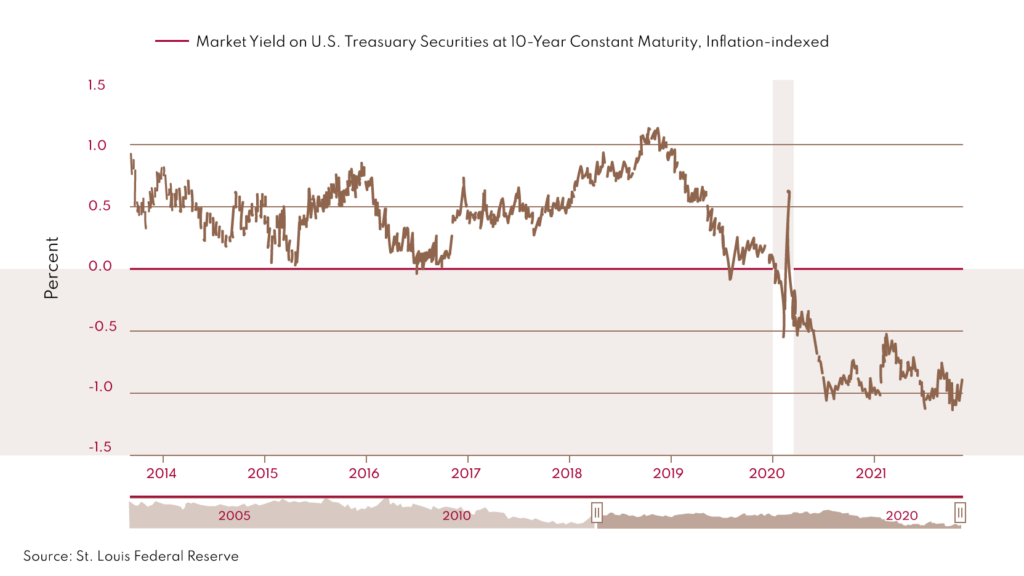

Short-term interest rates are determined by central banks. In the United States, the Federal Reserve (Fed) influences borrowing costs by controlling a short-term lending rate, called the federal funds rate. That rate is determined by the Federal Open Market Committee (FOMC), which consists of seven governors of the Federal Reserve Board and five Federal Reserve Bank presidents. To stimulate the economy, it has held the rate near zero since March 2020, when the coronavirus pandemic hit. But in economic models, it is the inflation-adjusted or “real” interest rate that matters most, because inflation reduces the value of future cash flows. “The real rate is arguably the most fundamental indicator of the stance of monetary policy,” wrote economists Christina Romer and David Romer in a 2004 paper.

Long-term interest rates are governed by the laws of supply and demand. Lower demand for a given issuer’s debt tends to result in higher interest rates, and vice-versa. For U.S. government debt, the resulting interest rates can be observed following auctions conducted by the U.S. Treasury Department.

The Effects of Inflation on Interest Rates And Real Interest Rates

When backing a loan or investment, banks will often advertise a “nominal interest rate,” which considers inflation. A real interest rate is an interest rate that has been adjusted to remove the effects of inflation, reflecting the real cost of funds to the borrower and the real yield to the lender or an investor. Adjusting the nominal interest rate to compensate for the effects of inflation helps to identify the shift in the purchasing power of a given level of capital over time.

Real Interest Rate = Nominal Interest Rate – Inflation (Expected or Actual)

Purchasing power is very important, as it directly impacts your way of living. Purchasing power is the value of a currency expressed in terms of the number of goods or services that one unit of money can buy. For example, if you earned a 5% return, but inflation was 6%, you can now buy 1% less with your money than you used to.

If long-term rates don’t rise as inflation climbs, then real long-term rates may decline even further, providing a stronger incentive for debt-fueled spending.

What Do Real Negative Interest Rates Mean for Bond Investors?

As of the end of September 2021, bonds worth more than USD 14.8 trillion, or more than a fifth of all the debt issued by governments and companies around the world were trading with negative yields.

A bond is a form of debt that can remain outstanding/owed by a company, government or municipality for a few weeks or even several years or decades. Unless there is a default, investors will get back the full amount they invested. The way these investments are structured, the issuer of the bond will make regular interest payments to the entities that hold the bond, over the bond’s lifespan, until its maturity. This regular interest payment investors receive on a bond is called a coupon.

This coupon and the price of the bond have a very important relationship which is called the yield. A bond’s yield refers to the expected earnings generated and realized on a fixed-income investment over a particular period and is expressed as a percentage or interest rate. Bond prices have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa. If the price of the bond decreases, the yield of a bond increases. If the price of a bond increases, the yield of the bond decreases.

When interest rates fall into the negative, bond prices go up, and the yield of the bond decreases. This is exacerbated by real negative interest rates, making real yields a real problem for bond investors.

How Did We End Up With Negative Interest Rates?

Over the last decade, global economies have seen low growth. Central banks have been reducing interest rates and injecting money into the economy through quantitative easing or QE. This was with the goal of making individuals like us less motivated to keep money stored in our bank accounts and instead spend it or invest it in riskier assets. This was also done to banks. The European central bank was charging European banks a negative rate to hold their money with the goal of encouraging banks to lend out their capital.

However, in mid-December 2021, the Federal Reserve signalled that it saw three rate increases in 2022. This may lead to the end of negative interest rates, but negative real rates could remain negative for some time.

Clearly, there are some hard choices ahead for bond investors. For those who care about the real rate of return, a long-term strategy that focuses on diversification can help mitigate some of the risks involved with investing in a negative interest rate environment.