Even before we reached the month of October this year, U.S. stock markets were shaping up for a banner year. As at September 30, the S&P 500, Dow Jones and NASDAQ were all registering sharp increases. Two months later, however, we’re back to the starting point. Although many claim that the Trump effect still has much to do with this, in reality, rising interest rates have played a much greater role.

When it comes to investing, the value of an asset is calculated based on the cash flows that asset will eventually generate. The same can be said of a private corporation, income property or publicly traded company. Future cash flows must be discounted (stated in current or today’s dollars) by applying a simple calculation and an appropriate discount rate. The latter is closely tied to interest rates set by various central banks. And the higher the rate, the more the value of future cash flows – the asset’s value – will be reduced.

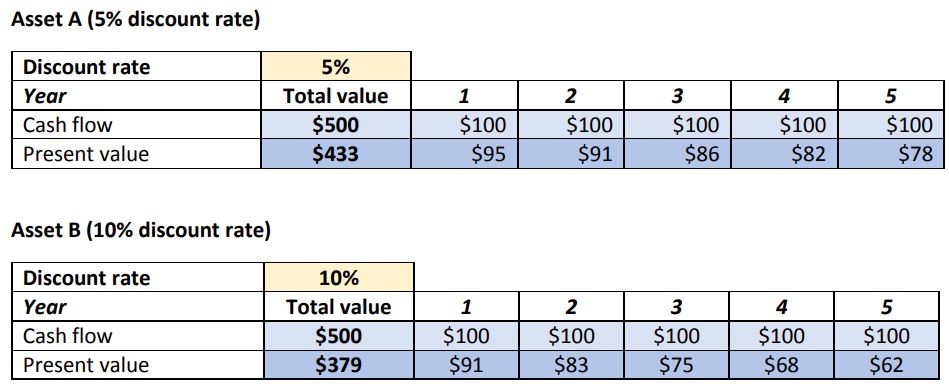

Example: Value of two assets calculated at different discount rates

Since we used a higher rate (10% > 5%), you’ll note that Asset B’s present value ($379) is lower than that of Asset A ($433). To draw a parallel with the stock market, when the U.S. Federal Reserve raised its key rate from 1.50% back in January 2018 to where it stands today, i.e. 2.25%, it increased the yield required on various asset classes, thus causing a stock market reassessment.

Does that mean one needs to withdraw from the market when central banks begin a cycle of interest rate hikes? Of course not! Central banks raise interest rates when growth is strong in order to avoid an overheating of the economy. Strong economic growth also means stronger corporate profits. And in the long run, it’s these profits that help drive stock markets. As well, let’s not forget that rather than interest rates at or near 0% as we’ve seen over the past decade, historically, rates have more typically stood in the 3–5% range. It is therefore perfectly normal to see them rise.

In our view, we don’t need to predict which direction interest rates will take in order to make money on the stock market. Rather, we believe that, although a well-diversified portfolio invested in solid names can certainly experience short-term fluctuations, it will perform well over time. Let’s not forget that it’s these same fluctuations that create opportunities… And it’s our job to identify them.

Happy Holidays!

The Claret team