Figuring out how and where to invest your money is hard enough under normal circumstances. But when markets experience a serious correction – like they did in 2020, as a result of the global pandemic – determining the best strategy for your investments can be a real challenge.

How can we manage risk? Let’s look at what many investors seem to be ignoring: diversification. Here, I’ll cover some of the benefits of diversification, and share a few of the easiest ways to diversify your portfolio in 2025 and beyond.

What is Portfolio Diversification? Why Does it Matter?

What are the benefits of portfolio diversification? While betting big on common shares in one or two companies in the hopes of quickly doubling your money sure sounds attractive, this strategy is more of a gamble than it is a sound investment decision. If both of these companies perform horribly – and there’s always a chance that could happen – you lose everything.

Diversification means that if one of the companies you own goes under, your investments don’t go down with it. As soon as you enter the stock market, you face two main issues that could result in loss: market risk and stock-specific risk. We have a very recent example of market risk if we look at the COVID pandemic that hit in 2020…

Market Risk vs. Stock-Specific Risk

What is the relationship between market risk and stock-specific risk – and how did that play out during the 2020-2021 pandemic?

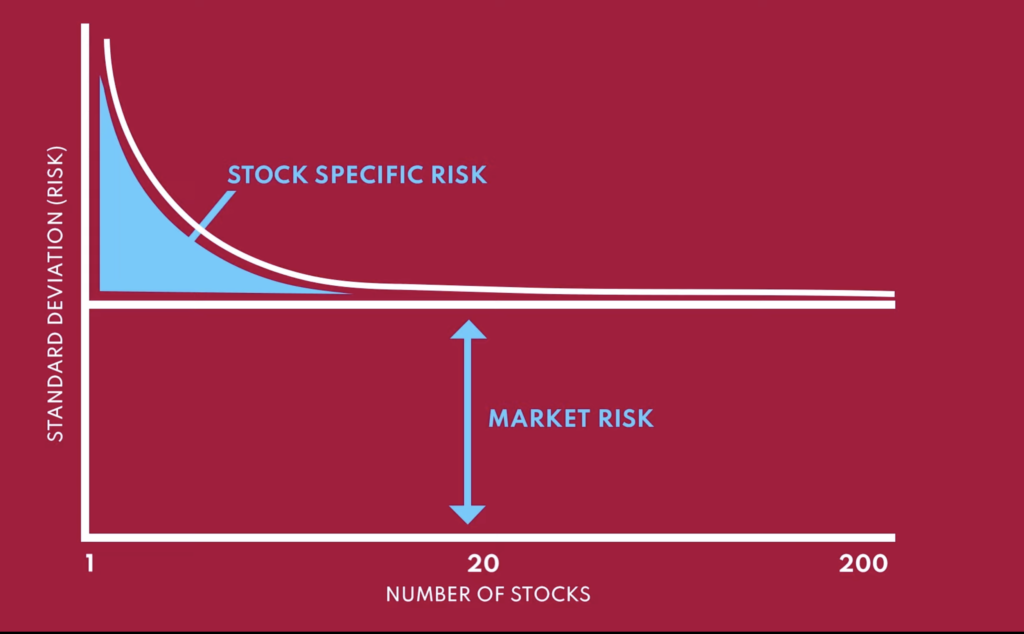

Market risk or systematic risk affects the performance of the entire market simultaneously and is often measured by volatility. Specific risk, or “diversifiable risk,” is the risk of losing money on your investment due to an industry-specific or company pitfall. Unlike market risk, an investor can mitigate against stock-specific risk through diversification.

Let’s examine how the COVID-19 pandemic affected markets in 2020. Looking at the S&P 500 index – a benchmark used to represent how well the stocks are doing in the United States – we can see a sharp drop when the pandemic hit in March. That is what we call “market risk.” No matter how good the stocks in your portfolio were, their market prices took a hit.

So, what are the best ways to diversify your portfolio – and how do you know if you’re diversified enough? Here are five easy tips to get you started on your diversification journey.

1. Generally speaking, hold at least 20 to 30 stocks for good diversification.

How many stocks should I own to be considered “diversified?” Again, we want to look at stock-specific vs. market risk, meaning, if we chart the risk of your portfolio based on the number of stocks in it, we need to first take into account the market risk. No matter how many stocks you hold, market risk will always be present. Then, on top of that, you have the stock-specific risk. Mathematical models show that a portfolio of 20 to 30 companies can be considered as sufficiently diversified, as you can see. Holding more names does improve diversification, but if your cost per transaction is high, this might become costly if you are over-diversified.

2. Diversify your stock portfolio across various industries

When you start investing in more companies, you must also take into account the correlation between them. If you buy the common shares of three banks, there is a very good chance that they will fluctuate in unison. Therefore, buying a bank, a software company, and an airline, for example, would already be a better way to diversify. Make sure you diversify your stock portfolio not just by the number of companies you own, but also by gaining exposure to a variety of industries.

3. Hold securities from different countries or regions (geographical diversification)

Among the stocks you hold, it’s common to introduce some level of geographic diversification, too. In the event of an economic downturn at home, holding companies outside of your country may help you reduce the negative impact of your local stock market exposure. Investors are often prone to home bias, which defines the propensity to invest a disproportionate amount of their investments, domestically.

4. Diversify by asset class

Another way to diversify is diversification by asset class. For example, you may want to hold fixed-income securities, such as preferred shares or bonds. Contrary to popular belief, bond prices can fluctuate a lot during a market correction. However, since this is a debt that the company agreed to repay to you along with the interest payments, the risk is different than it is for common shares. Because bonds have a higher priority in case of bankruptcy, they are considered “less risky.” You can also hold a portion of cash in your portfolio. This helps you remain diversified because your cash won’t go away if the market dives while allowing you to buy companies at a discount if that does happen. By the same token, diversification among different asset classes can help mitigate some of the market risks in your stock portfolio.

5. Consider pooled funds for easy diversification

By holding a pooled fund, a mutual fund or an ETF, you can easily have access to the benefits of diversification. Since many funds hold dozens of companies across different business sectors, and you can easily pick two or three funds to diversify geographically, or by asset class. Alternatively, these funds can easily be held in addition to your 30 individual stocks. Pooled funds could be used to apply an investment strategy on a larger number of companies, and would be designed for those other geographical regions.

Remember, the primary goal of diversification isn’t to maximize returns but to limit the negative impact of volatility on a portfolio. In other words: make sure you aren’t overly invested in any one area. By using these diversification tips, you can limit some of the risks in your portfolio.