We’ve all heard the phrase, “Don’t put all your eggs in one basket.” If you’ve invested too much in a single stock, you may be risking all your eggs. That’s why investors create diversified portfolios to limit single-stock risk.

But how do you know if you are investing too much (or too little) in a single asset class? This is where asset allocation comes into play.

What is asset allocation?

Asset allocation is an investment strategy that aims to balance risk and reward by allocating a portfolio’s assets according to an individual’s goals and circumstances, risk profile, and investment time horizon.

There are three main asset classes: equities (stocks), bonds (fixed income) and cash. These three asset classes have different levels of risk and return, so each will behave differently over time.

Speaking of time: Your investment timeline is another very important factor in determining asset allocation. Are you building a nest egg for retirement? Or will you be withdrawing funds on a regular basis, while still trying to build wealth over time? Your lifestyle, goals, and risk preference all help determine your asset allocation.

Asset allocation models: Which strategy is right for me?

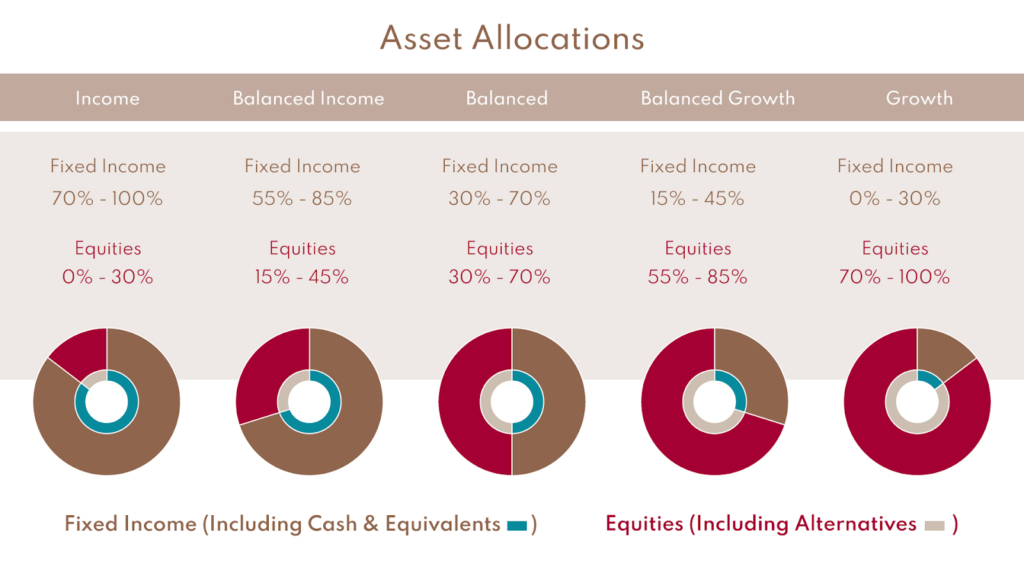

Determining the right mix between stocks and bonds is essential to helping your portfolio achieve your long-term goals. There are three main asset class allocation groupings: income, growth and a mix between the two, which is appropriately called “balanced.”

Income portfolios are designed to generate income for their holders, who are typically nearing retirement or retired. They often consist of fixed income securities that pay you money throughout the year, as well as dividend-paying stocks.

Growth portfolios, on the other hand, are designed for people who are just beginning their careers, and are interested in building long-term wealth. The assets don’t need to generate income, because the owner is actively employed and living off their salary to pay their expenses. Unlike an income portfolio, the investor is likely to increase their position each year by depositing additional funds. For the most part, growth portfolios are invested in common stocks.

Why you need an asset allocation strategy

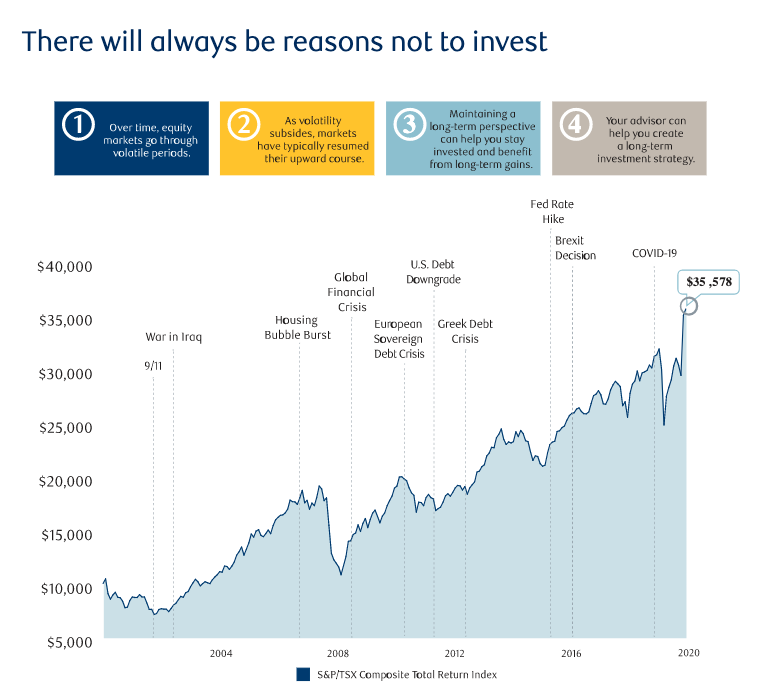

When markets fall, investors get nervous. They might wildly move or sell assets, worrying about the ramifications to their financial health. When markets rebound and start climbing again, investors get over-confident, willing to take on more risk to see their assets grow faster.

Volatile, emotional investing is short-term, and rarely successful. A long-term investment plan requires a disciplined approach, taking emotion (and rash thinking) out of the equation. Choosing the right asset allocation strategy from the get-go can help you avoid a lot of common investment mistakes.

Combining income and growth asset allocation models into a balanced portfolio is a nice compromise between the two models. For most people, a balanced portfolio is the best option — if not only for financial reasons, then emotional ones. As we can see in the chart above, there is almost always a reason to think the world is going to end and avoid investing.

Ideally, you want a mix of assets that generate income, as well as capital appreciation over time, with smaller fluctuations in quoted principal value than the all-growth portfolio.

Changing your asset allocation to meet your needs

Of course, your investment needs will change as you move through various stages of life. For that reason, your portfolio manager will recommend switching over a portion of your assets to a different model, ideally several years prior to anticipated major life changes.

An investor who is five years away from retirement, for example, might find himself moving 10% of his holding into an income-oriented allocation model each year. By the time he retires, his portfolio will reflect his new objectives. At Claret, we offer balanced growth and balanced income investment portfolios to make sure your portfolio is still aligned to best serve your needs during these transitional years.

Do you feel like your asset allocation is keeping up with your goals? Do you look at your asset allocation from a before-tax or after-tax perspective? Have you ever thought about how you asset location (i.e. the type of account it’s held in or the security’s country of origin) affects your asset allocation? Maybe it’s time for a second opinion so that we can ensure you are making the best choices for your lifestyle.