The Canadian stock market has been the superstar among the G7 countries, having outperformed most major indices by a wide margin. As you have probably read by now, the commodities sector, more specifically oil & gas, is the main topic in most financial newspapers, being featured as “the place to be” for anybody who wants performance. Even American investors are plowing into the oil and gas sector by buying many royalty trusts (oil & gas income trusts).

The following table summarizes the price performance of the main indices for the third quarter and the first nine months of 2005.

| Third Quarter | First nine months | |||

|---|---|---|---|---|

| In local currency | In Canadian Dollars | In local currency | In Canadian Dollars | |

| S&P/TSX (Cdn) | +11.20% | +11.20% | +19.09% | +19.09% |

| S&P 500 (US) | +3.15% | -2.08% | -2.23% | -4.32% |

| Nasdaq (US) | +4.61% | -0.70% | -5.26% | -7.28% |

| Europe (EUR) | +7.66% | +1.51% | +15.39% | -0.07% |

| Nikkei (Japan) | +17.18% | +8.70% | +18.00% | +3.45% |

As far as the major currencies are concerned, the Canadian Dollar’s strength is persisting while the Euro is languishing versus the US Dollar. We believe the Loonie should continue to perform well over the foreseeable future. As for the Euro, the German election last month epitomizes the European problem: the Old Continent is more interested in social stability rather than free market economics which usually comes with some dislocations from time to time. Unfortunately, strong economic growth relies on free market principles and entrepreneurship, both of which are lacking in Western Europe. As long as these conditions persist, we don’t have a reason to be bullish on the Euro except for short term trading purposes.

Gold has performed quite well recently. As a gauge for inflation, this does not augur well for interest rates: the increasing price of gold usually signals that the Federal Reserve is printing too much money. As the Fed corrects its course by reducing the money supply, interest rates tend to move up.

Over the last several months, we have witnessed several events that make us more and more cautious about financial markets. Our thesis for the last 3 years has been that we are in a cyclical (shorter term) bull market within a secular (longer term) bear market. In other words, we are in a short term rising environment within a long term, flat to declining market. With some indices near record highs, we thought we should review what we see as the main risks going forward:

-

Oil prices have spiked up over US$ 70 a barrel before settling down to US$ 65. Filling up the tank is twice as expensive as it was two years ago. This effect will filter through all areas of the economy. With an already tight labour market in North America, firms will be pressured to raise wages in order to keep their employees commuting to their workplace.

In Asia, amid fears of inflation and potential backlash from motorists and farmers as well as to avoid social unrest, governments have put in price control mechanisms, including price caps and subsidies on fuel. Unfortunately, basic economics teaches us that price control policies always lead to two major problems: shortages of supplies, as producers divert products to higher bidders, and black markets, as consumers pay higher prices to get what they need. The problem is becoming so acute that the Indonesian government this month cut fuel subsidies, which had the effect of doubling fuel prices. China confirmed that it is also working on changes to its price fixing regime aimed at adopting a more market-oriented system.

-

The US trade imbalance continues its path of deterioration which began in the beginning of the 90s and accelerated since 2000. With energy import prices surging, it will not improve anytime soon. By themselves, trade deficits have never been a problem. However, combined with foreign ownership (OPEC, China) of about 50% of the US treasury debt, it could become quite problematic.

-

Housing prices should be related to disposable personal income and the rent these properties can produce. As of June 30, 2005, the value of residential real estate in the US is 204% of disposable income and housing prices are growing faster than rent by almost 10%. Both indicators are at record highs. Thus, it appears that housing is overvalued relative to personal income and by the rent that can be obtained.

|

|

-

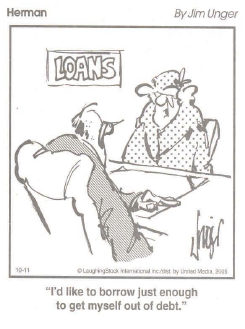

US domestic non-financial debt is at a record level of 308% of US Gross Domestic Product (it would be as saying that everybody is owing 3 times what they earn before taxes). Although this seems to be manageable at very low interest rates and ever increasing asset prices, any change in investors’ perception of risk could have a dramatic effect on the value of the assets financed with this debt and could eventually lead to its liquidation (i.e. through bankruptcies). Even Alan Greenspan recently warned, “…History has not dealt kindly with the aftermath of protracted periods of low risk premiums.”

In conclusion, secular risks remain high; selectivity and patience are of utmost importance. Our bottom up approach in our stock selection has not yielded too many buys these days. As you know, we do not create opportunities; we merely identify and take advantage of them. Unfortunately, these opportunities seem to be few and far between.

Claret Asset Management