Stock market volatility can be troubling when it comes to your investments. Crashes are vivid, scary events, and when the market tanks, we panic.

The good news is that despite the headlines, there are strategies for dealing with these ups and downs. Not only is volatility normal and unavoidable, but it can even be a good thing for investors who know what they’re doing.

What is Stock Market Volatility?

Let’s start with the definition of volatility. When we refer to stock market volatility, we are talking about prince swings in the market. These fluctuations can be nerve-wracking if you think that the market prices can only go up.

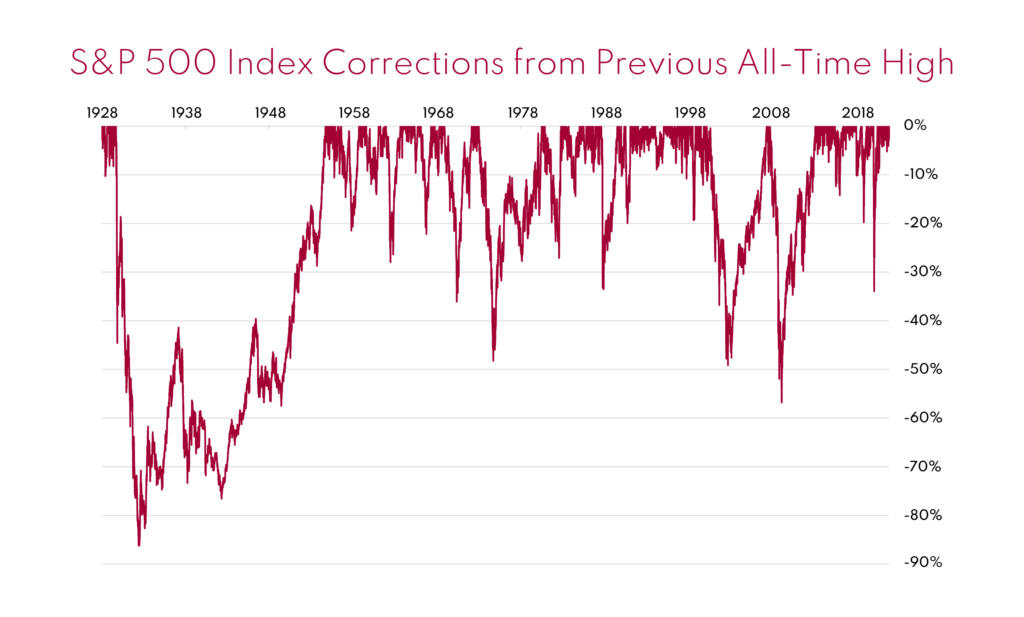

History has shown that although the market goes up in the long term, it is definitely wrong in the short term. As you can see on this first graph, over the past 90 years, the S&P500 index has only recorded new all-time highs about 5% of the 33,000 days throughout this period.

This means that for the other 95% of the time, you are left wondering why your portfolio isn’t performing as well as it once was, hoping it will climb back up again.

In other words: if you constantly keep only the highest value of your portfolio in mind, you will almost always be disappointed.

How to Take Advantage of a Volatile Stock Market

What if I told you that next year, you could make a little over 16% on your portfolio when the average annual return for the past 100 years has been around 9%?

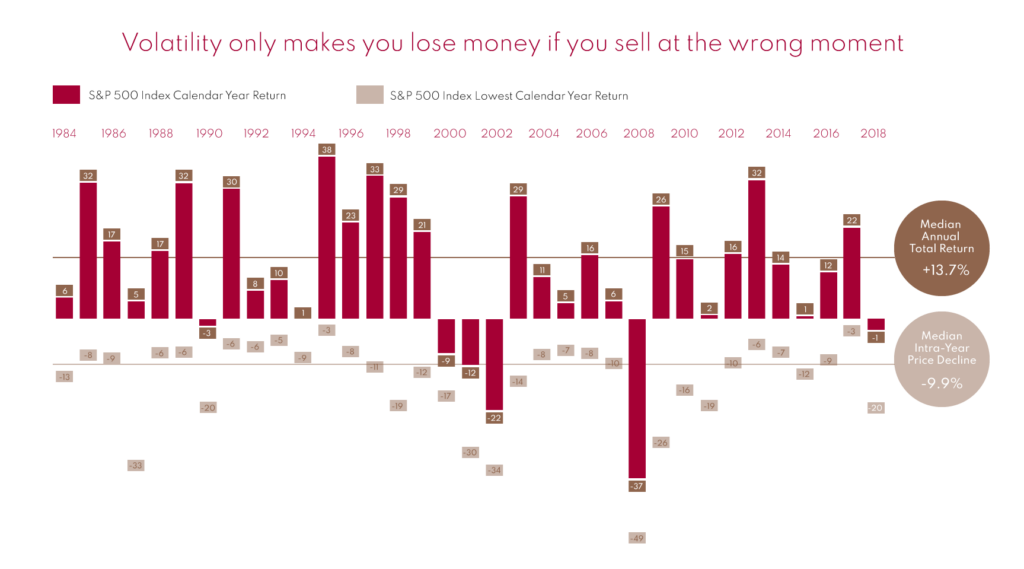

This was the reality in 2020 – where the calendar year return was an impressive 16%. Remember that this was also the year during which the stock market, as represented by the S&P 500, plunged over 30% due to the pandemic.

This is a prime example of how volatility is only a risk if you are investing with a short time horizon and are forced to sell at the wrong time or even worse, you could sell perfectly good stocks out of panic. If we look at history again, each year, the market sees a period of significant decrease.

Below are the annual returns since 1984. As you can see, most of the time, the market had positive annual returns. However, the average intra-year price decline is nonetheless close to 14%.

Why Volatility Can Mean Opportunity

It helps to think of volatility in the stock market like a sale when shopping for clothes – for example, Black Friday or Boxing Day – except you’re not sure when this sale is going to happen. In this context, market volatility should instead be viewed as an opportunity.

You should be glad when you see the markets going down, especially if you are younger and accumulating capital. This means that you can add money to your portfolio and use the opportunity to buy your stocks on sale.

If you are able to invest in good companies at a cheap price and hold on to them for a very long time, you may very well be on the right path. As Warren Buffett once said: “Our favourite holding period is forever.”