Investors who use so-called “zero-commission” online brokers are often surprised when they are hit with hidden fees and charges. The truth is, there is no such thing as a free lunch. “Free-trading” online brokerages like Wealthsimple and Robinhood aren’t as “free” as they claim to be, and in fact, earn money from your investments in several different ways.

When it comes to commission-free platforms, here is how much you are really paying to trade.

Payment for order flow (PFOF)

Popular free-to-trade firms generate revenue through PFOF, which stands for Payment For Order Flow.

Here is how it works: Let’s say you want to buy a share of Apple. You go to your free-to-trade stockbroker and hit the “buy” button, and the stock magically appears in your account. You are happy and move on with your day. What you do not see and do not know is what happened between the moment you hit buy, and when the share showed up in your account. In a few milliseconds, your broker directed the trade for a fee to someone else, most likely a market maker, who paid for and intends to profit from your order flow.

At the end of 2020 (more specifically, December 17, 2020) the SEC charged Robinhood of misleading customers about how it made money, allowing trades to be executed so poorly that customers came out worse for their investments after taking into account the company’s “free” commission. You get what you pay for. Robinhood settled the charges for $65 million, which was barely a drop in the bucket for a company that might be valued as high as $40 billion when they IPO, according to Bloomberg.

But what about NBBO (National Best Bid and Offer)? The Securities Exchange Commission’s (SEC) regulation NMS requires brokers to trade at the best available ask and bid price when buying and selling securities for customers. Brokers must guarantee at least the NBBO-quoted price to their customers at the time of a trade. This is the rule Robinhood violated, hence the charge. It’s worth mentioning, however, that the proceeds of the settlement were not distributed among the customers who were wronged.

Currency conversion commissions in free-to-trade platforms

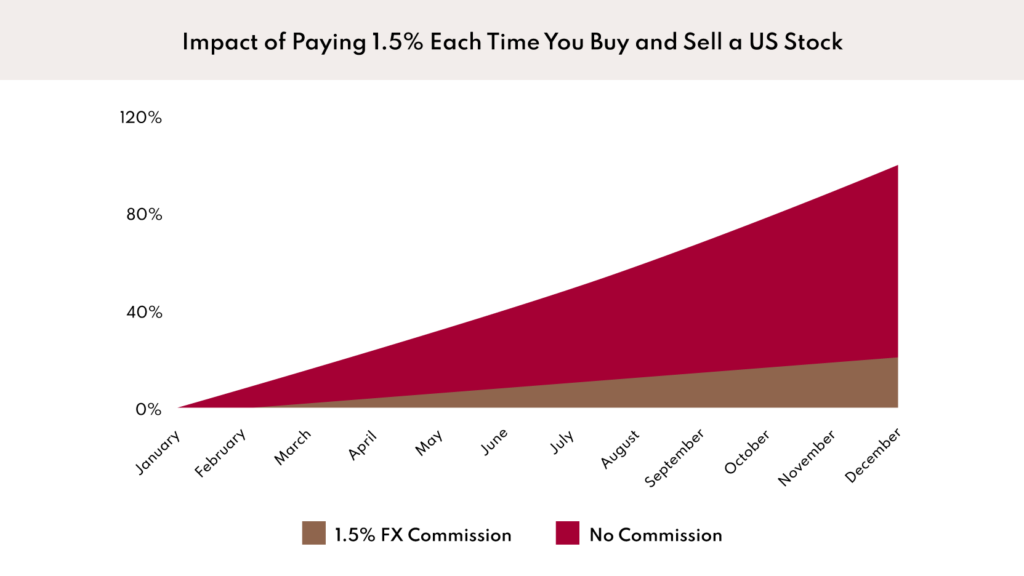

Another way free-to-trade platforms make money off their clients is by taking a commission on currency conversions. Take Wealthsimple. This popular, Canadian free-to-trade website charges 1.5% commission on these transactions. Most people would think that 1.5% isn’t that bad, but remember, Wealthsimple clients pay this fee each time they buy and sell foreign currency. Although they are not technically paying fees on the trade, it still means 3% of the round-trip conversion goes straight into Wealthsimple’s pocket — and that is very expensive! And this is before you even consider that there may be a spread already embedded in the rate they are giving you. Once again, this becomes an expensive lunch, and you’re the one footing the bill.

To put this into context, let’s say you make 12 trades a year (one per month) and each trade earns 5% every time, but it is always in a foreign currency. Unless you open a new USD account at 10$/month, each and every time you make a trade that is in USD, you will be hit with a 1.5% currency conversion rate. Thanks to the magic of compounding, you should have made a 79.59% return over the year. However, due to the commissions you paid, you end up having only made a 26.82% return. Yikes.

CRM2 to the rescue

When purchasing any service, it’s important to know about fees upfront. This is why CRM2 is revolutionary in the field of finance. CRM2 is short for “Client Relationship Model 2,” and refers to rules for Canadian investment dealers and advisors that require greater transparency about the cost, and performance of client accounts. Claret provides a CRM2 disclosure to each of our clients so that they know exactly what they are paying and how much. The point is to always know where your money is going. Do not make the mistake of paying hidden fees.