Let’s say you want to save up enough money for a down payment on a house. You’d like to invest your down payment and make it grow so that you can buy a home or condo in a couple of years, hopefully with some extra cash, thanks to that investment.

Sure, this seems like a good idea. But you don’t know how easy it is to lose money in the short term instead of earning money on the stock market – or how much you stand to lose. Here, we’ll explain why investing in the stock market may not be a sure bet if you have a short-term time horizon of two years or less.

What is Market Risk? Market Volatility In Short-Term Investing

We first need to look at market risk to understand how stock market gains and losses work. Market risk is the underlying risk associated with investing that cannot be avoided or diversified away. That’s why diversification is so important—it can prevent your portfolio from completely tanking when faced with volatility. Do you have a financial goal that you plan to materialize in the near future? Market risk is your worst enemy.

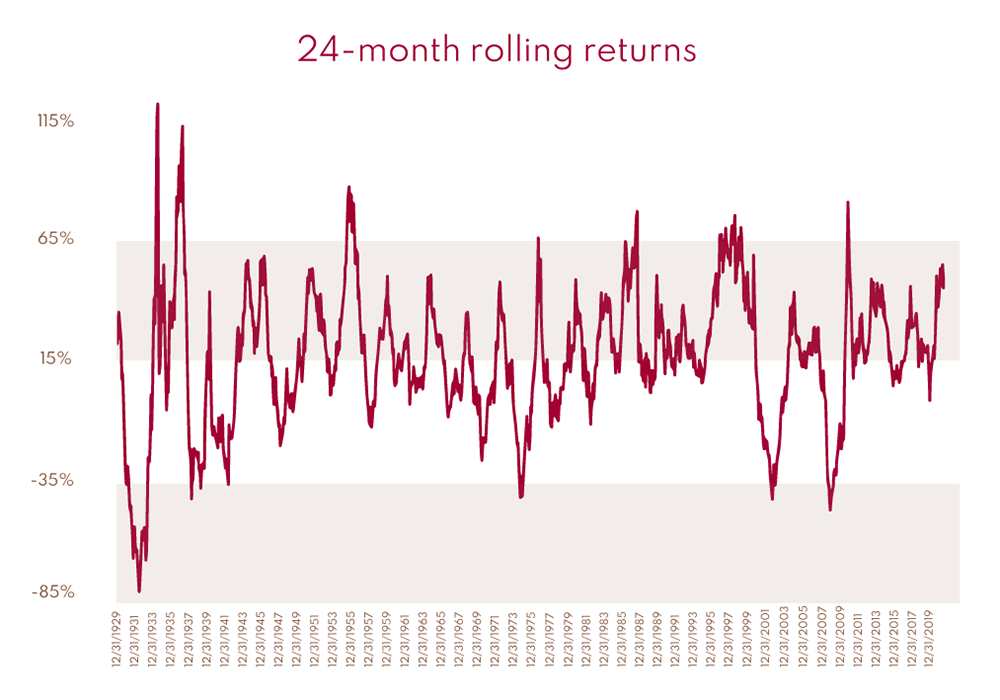

So, what are your odds of losing or winning on a short-term investment horizon of just two years? Looking at the last 90 years of the S&P 500, history shows that even with a diversified portfolio comprised of the 500 largest US public companies, you still have a roughly 24% chance of losing money over two years. There can be huge dips and spikes from one year to the next. Chances are, you won’t lose 2 or 3% of your money. Depending on whether it was a good year or not, you could lose even 30% or 40% of your initial investment.

This graph shows the rolling two-year returns of this index.

Having a 75% chance of making money sounds pretty good. However, it doesn’t account for how much or how little you might win or lose. And if it’s a significant loss, well – there goes your down payment.

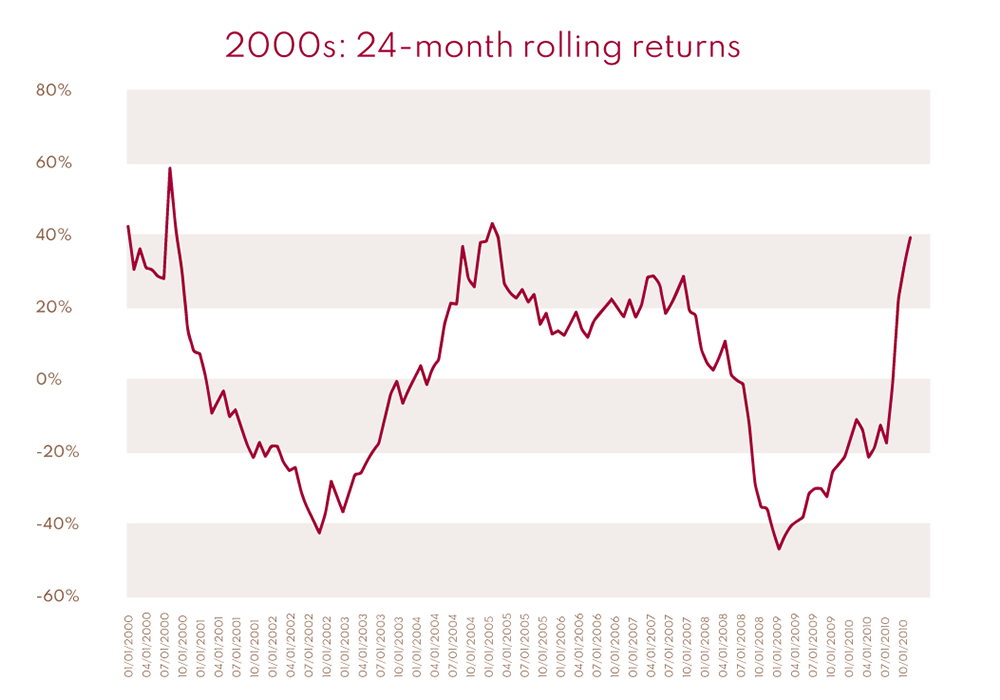

Not only that, but these averages also include excellent periods, like the past 10 years, which are still considered among the best bull markets. If we look at the decade just before that (the 2000-2010s), the odds of losing money were much higher, at around 46% over 2 years. During the 2000s, if you invested in the stock market, you basically flipped a coin and hoped you wouldn’t lose money over a two-year period.

If you had invested your home down payment at some point in the 2000s, hoping to grow it and take it out in a couple of years, you could have easily lost up to half of your cash – depending on how unlucky you were. That’s why a long-term approach to investing is so important.

5-Year, 10-Year, and 15-Year Period Investments

We know investing in the stock market for just two years in the hope of winning some money is a risky bet. But what about five years, 10 years or 15 years? What are the odds then?

At five years, the odds of losing on your initial investment are slightly better, at approximately 21%. So if you’re looking to make money on your down payment on a house in five years, that’s a better time horizon to consider, but it’s not for the risk-averse. After all, there’s still a 1 in 5 chance that you’ll end up with less money than you put in.

Another thing to remember is the current Canadian housing market, which shows no signs of slowing down. Even if you experience some modest gains on your down payment in the stock market, you might still be priced out in five years, depending on your city. The odds of experiencing a lucky windfall covering the rising cost of homes become even smaller.

What about 10 years? With a longer time horizon, your chances improve substantially. Your odds of losing money over 10 years fall to 12% and less than 4% at 15 years. Remember, how much you lose or gain depends on your initial investment and other factors. But you’re still far less likely to lose half or more of your investment when invested over a more extended period.

These probabilities are based on the S&P 500 Index, without the dividends. While similar over two years, the odds of losing money over five, ten, or fifteen years become much lower when considering the dividends that would be included in the S&P 500 Total Return Index.

Of course, slowly growing your house downpayment over 15 years isn’t realistic for most people. But long-term investing is a surefire way to increase your wealth for retirement, a child’s or grandchild’s education and other longer-term goals.

Short-Term Stock Trading: Proceed With Caution

It’s never been more accessible or affordable to the stock market. Thanks to robo-advisors and apps like WealthSimple or Robinhood, the barriers to entering the stock market have never been lower. Over the last few years, the trend toward short-term trading – with significant risks and potentially huge wins and losses – has made investing look more like gambling. It may be very tempting to take your hard-earned savings and try to grow them in the short term by trading stocks. However, if you aren’t careful, short-term investing can have negative, long-lasting implications on your portfolio and tangible consequences on your life goals.

Entering the market at the right time can significantly influence your success, especially if you’re only investing for two years. But timing the market perfectly is nearly impossible. The best strategy for most of us is not to try to market-time at all, but instead, make a plan and start investing regularly as soon as possible.

If you still want to try your hand at short-term investing, you should only put a small portion of your available assets in the market – a portion small enough that it won’t prevent you from buying the house of your dreams when you finally find it.