For the first 6 months of 2023, the S&P 500 gained a whopping 15.91%, the second-best first half of this century. One of Wall Street’s adages – the market does what it needs to do to prove the majority wrong – came true again. However, given the index’s decline of 19.44% in 2022, the S&P 500 is still down 6.63% over the last 18 months. Meanwhile, the SPTSX, having advanced only a modest 4.56% in the first quarter, barely budged in the second quarter.

We feel sorry for the professional forecasters who, since the beginning of 2023, predicted doom and gloom for the year. Coming into 2023, a Bloomberg survey of 25 Wall Street strategists showed a negative S&P 500 target for the first time since its inception in 1999. Yet, they get paid a lot of money for not being right most of the time… I think Warren Buffett got it right when he said: “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Worried about the Canadian housing market?

For the last 40 years, as interest rates declined from 22% in 1980 to 0% in 2022, we have witnessed in Canada an amazing increase in housing prices, only punctuated by small corrections in the early 90s and early 2000s. Not even the Great Financial Crisis of 2008-2009 managed to put a dent in the Canadian residential real estate market. Nobody in Canada believes that their houses can ever go down in value.

Consequently, household debt in Canada is now the highest of any G7 country, according to data from the country’s housing agency. The amount owed by Canadian households is also higher than the country’s entire GDP.

The math between housing prices, interest rates and mortgage payments

When people talk about housing affordability, it basically refers to the house price one can afford based on one’s salary, taking into account a realistic down payment (usually 10% to 20% of the house price) and the size of the mortgage one can get from the banks. During Berkshire Hathaway’s annual meeting last May, someone asked Warren Buffett how he evaluates the intrinsic value of a building. He ironically answered: “How much can I borrow without signing my name?”

Housing prices are pretty much decided based on how much the banks are willing to lend the buyer as a mortgage.

Let’s go through an example: according to the CMHC, one should limit the monthly mortgage payment to less than 39% of one’s monthly pre-tax gross income. So, if one’s monthly income is $7,000 (annual salary of $84,000), one should not spend more than $2,730 per month on mortgage payments.

In 2021 when interest rates were at their lows, a 5-year fixed mortgage rate could be had for 2.15% and a variable rate was at 1.46%. For someone with $2,730 available for monthly mortgage payments, they can afford a mortgage of just over $630,000. Let’s say one has saved up (with or without the help of The Bank of Mom and Dad) $140,000, one can then afford a house price of $770,000. Alternatively, one can afford an even bigger mortgage if one goes for a variable rate mortgage: at 1.46%, $2,730 would fund a mortgage of $685,000, and with the same $140,000 down payment, one can afford an even higher house price of $825,000. From the example, we can see that house prices are intrinsically linked to interest rates that dictate the terms of mortgages.

Fast forward to 2023: the interest rate is now at 5% and $2,730 will only cover a $470,000 fixed mortgage. It also means that with the same down payment of $140,000, one can only afford a house price of $610,000 ($470,000 + $140,000).

It also means that for the house that one was willing to pay $770,000 for in 2021 (because one could afford to borrow $630,000 then), one can only afford to pay $610,000 today (because one can only afford to borrow $470,000 now).

It looks like, in the potential new buyer’s eye, the same house is worth $160,000 less ($770,000 – $610,000), a whopping 21%…based on affordability.

For all those who bought houses and condos in 2020-2021 when interest rates were so low, it will be a while before they can find buyers who can afford to pay more than they did back then. This is what worries us in the Canadian residential market. It will take years to work out the excesses since most mortgages were based on fixed rates (usually 5 years) and do not come to maturity before 2025-2026. In the meantime, potential buyers become more scarce due to their borrowing capacity being tremendously curtailed by the steep rise of interest rates.

Come to think of it, people actually buy houses based on the amount the banks are willing to lend them in a mortgage.

Could you think of anything else people would buy based on how much they can borrow? Better yet, could you think of any investment one would make based on how much one can borrow? No wonder housing prices are so out of whack with personal disposable income…

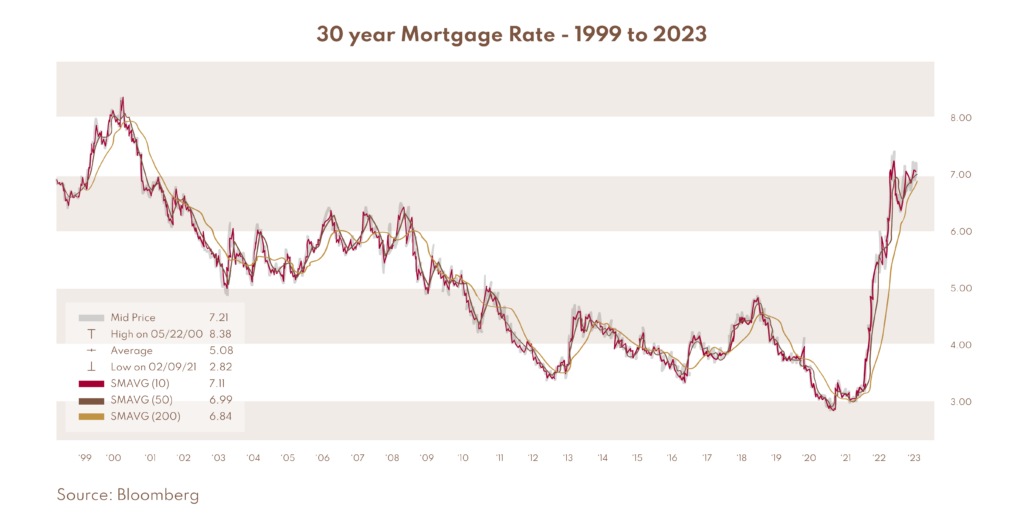

In the last quarterly letter, we touched on the topic of a changed interest rate environment:

- “Interest rates have declined from 20%+ in the early 80s to 0% during the pandemic of 2022, a decline of 2000 basis points. (1 basis point is equal to 0.01%). As we are writing, rates hover around 2-4%. One thing is for sure: from this level, they cannot go down another 2000 basis points…

- With a tight labour environment, wages are still rising. Combined with geopolitical problems slowing down globalization, inflation is not about to go back below 2% any time soon.

- If Economics 101 teaches us anything, it is that real interest rates – which is generally accepted to be the rate of interest on 3-month treasury bills minus the rate of inflation – must be positive for savers to save. Without savings, there will be no investment and no economic growth long term. Therefore, if inflation stays at around 2%, nominal interest rates would have to be around 2-4%, as they are now…”

A few more comments are warranted:

- We think the least often recognized but most important economic factor in the last 40 years is the decline of interest rates from 22% in 1980 to 0% in 2020. It was a great period for asset owners and cash borrowers. It was a massive tailwind for investors but rarely recognized as such.

- However, beware of the Frog in The Water syndrome: 40 years of declining interest rates make people feel complacent. Just like the frog in the water that is boiling slowly, it will not perceive the danger and will be cooked to death.

- Most of us don’t recall an environment when interest rates consistently rose. We need to go back to the 70s. But the 70s were not normal times either. Rates were going up from 5% to 22%…

- The 50s and the 60s were more “normal” and interest rates were around 2%-4% and mortgage rates were 5%-6%, as they are now…

- In the last 14 years since the Great Financial Crisis, it was impossible to make decent money on credit instruments like corporate debt. The Fed was extremely stimulative by keeping interest rates so low that most fixed-income portfolio managers had to bet on rate movements in order to produce decent returns. These strategies are tantamount to gambling on the direction of interest rates. Now, the environment has changed: high-yield credit instruments are now approaching 9%, providing investors with an equity-like return but senior to equity in capital structure, and therefore in principle less risky.

- In the first half of this year, the “magnificent seven” as they are called – Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla – dominated the performance of the S&P 500. They are up between 35% to 75% and as for the other 493 stocks, performance has been flat.

- This is reminiscent of a period commonly called the “Nifty Fifty”: in the late 1960s, there were roughly 50 companies in the US that everyone believed should be owned forever: Coca-Cola, IBM, GE, Procter and Gamble, MacDonald and other well-known names. These stocks were often described as “one-decision” stocks, as they were viewed as extremely stable, even over long periods of time. They powered the bull market of the late 60s and the most common characteristic of these constituents was solid earnings growth for which their stocks were assigned extraordinarily high price–earnings ratios. Trading at eighty times earnings was common…

- Sadly, they also created the extremely painful bear market of 1973-1974 when reality set in, an example of unrealistic investor expectations for growth stocks.

- Some perspectives on the market: in general, markets are fairly valued. Sometimes, it gets cheap and sometimes it gets expensive.

- However, as the legendary investor Howard Marks recently explained, he only made real market calls (i.e. when it gets cheap or expensive) 5 times in his 50-year career because most of the time, it is fair.

- What matters for us is to be able to concentrate on the fundamentals: our job is to buy companies that hopefully increase their intrinsic value over time and bonds that pay interest and capital back as written in the contractual agreement.

- We define risks as permanent impairment of capital and NOT volatility. In fact, without volatility, we would never be able to buy anything below its intrinsic value. Someone needs to panic and sell for you to be able buy something cheap…

- Volatility is only a problem if one needs the money (liquidity) during down markets. Otherwise, markets always recover and go to new highs with time. We would not have the Dow Jones at 35,000 today (starting from 100 in 1920) if markets didn’t have an uptrend bias…

As a side note, we watched “The Drops Of God” on Apple TV. For those who love wine, it is a very good series. In the last episode, one line caught our attention that sums up the market so well:

“What will happen now?”

“The winds of tomorrow… will blow tomorrow…”

Have a warm and happy summer!

–Alain Chung, CFA, Chairman and CIO, on behalf of the Claret team.