Higher education has never been more expensive; university tuition fees have risen more than 40% in the last decade, and according to Statistics Canada, the average Canadian undergraduate student will pay $6,693 in tuition per year (check out their helpful tool, which details the cost to study in a given field based on the province). In the United States tuition is even more exorbitant, ranging from $10,338 for public state universities all the way to $38,185 a year or more for private undergraduate education. That’s before considering the costs of textbooks, laptops, housing… and the list goes on and on.

You may have already heard about Canada’s Registered Education Savings Plan, or RESP, which can help parents or grandparents save money to help shoulder the burden of paying for school. But how exactly does the RESP work? What does it cover, and what is the best way to invest your savings to maximize your returns? Here, we break down everything you need to know about the RESP so that you can secure your child’s bright future.

What is an RESP?

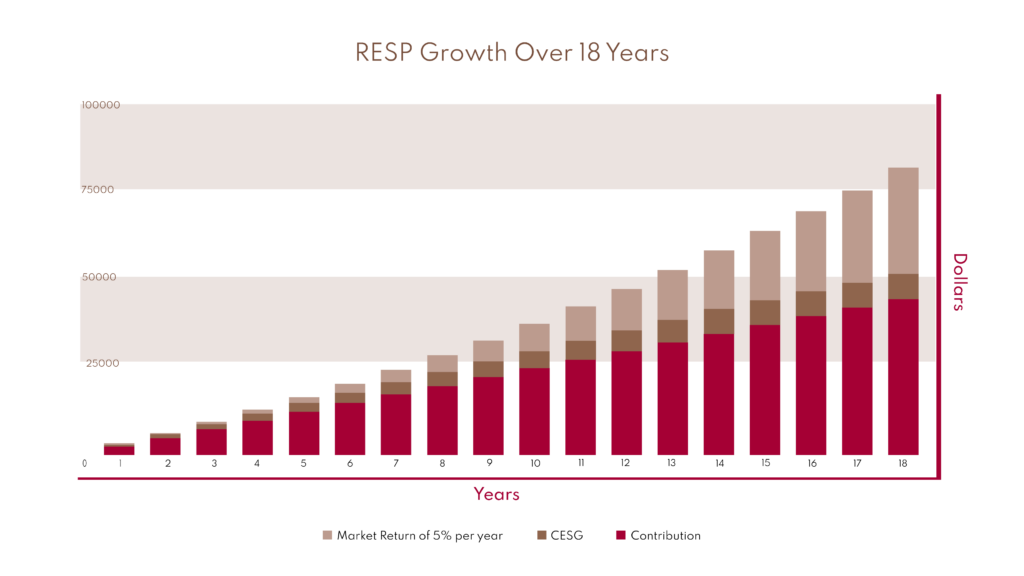

An RESP is an investment account where the money deposited will grow tax-free and can even qualify for additional grants such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond. The RESP also has a lifetime maximum contribution of $50,000 per child, and the lifetime CESG grant is $7,200 per child. Each year, when you contribute $2,500 to the account, the government will contribute $500 (or more based on your family’s adjusted income) to the RESP.

If invested wisely, that amount can go a long way to help cover expenses related to education.

Three types of RESPs

There are three different types of RESPs you should know about, each with its benefits and drawbacks. Carefully consider each of these options to see which works best for you.

1. Individual RESP

This is a great plan if you have only one child (and do not plan on having others). If you have more than one child, we highly recommend you choose a Family Plan RESP instead.

Pros:

- You can combine individual plans into a family plan as long as all of the beneficiaries (attached to those individual plans) are related to you (‘the subscriber’) by blood or adoption.

- You can choose the type of investments and your investment frequency (timing, amounts, etc. which is unlike a group plan—see below).

Cons:

- If you were to change the beneficiary to a child not related to you by blood or adoption, you would have to pay back any CESG and CLB (Canada Learning Bond) money.

2. Family Plan RESP

You can name one or more children to receive the savings when it is time to pay for their studies after high school. The children must be related to you, either by blood or adoption. The advantage of a family plan is that earnings can be shared among the children, and the Canada Education Savings Grant may be used by any beneficiary named in the RESP. What if you already have an individual RESP plan and you have another child? Don’t worry; you can easily change your RESP to a Family Plan.

Pros:

- Adding beneficiaries (with every child born) requires less paperwork than creating a new individual plan.

- Money in the plan can be shared between children. CESG can also be shared between children in the plan up to a maximum of $7,200 per child.

- Interest income or capital gains can be shared by the number of children/beneficiaries in the plan.

- Similar to an individual plan, you can make your own investment choices.

Cons:

- All beneficiaries must be related by blood or adoption.

3. Group Plan RESP (to avoid)

Also known as a scholarship or ‘pooled’ plan (because it ‘pools’ the contributions of many investors), this is the plan where caution should be exercised. Usually, you will be asked to commit to making regular payments into the plan over a certain period. Fees may apply if you stop these regular payments. In a CBC story, a mother of two who requested to transfer her money to another institution was told she would lose two-thirds of it. She was unaware of these costs and blamed their lack of transparency when she signed up as a new mom in a vulnerable position.

Pros:

- You don’t need to be related to the beneficiary.

- If other people leave the plan early, you could receive a share of their earnings (this can be a double-edged sword).

Cons:

- If, for any reason, you have to leave the plan early, any gains on your contributions would then go to the other plan members. In this case, there is a possibility you would receive far less than what you initially put in (because of the fees and sales charges typically associated with these plans).

- If your child does not begin post-secondary education at the same time as the rest of the group, the earnings you receive from the plan may be affected.

- Your plan could also be terminated without notice, and you may have to give up your investment earnings.

If you want to learn more about RESPs or how they could be beneficial to financially supporting the future education of your children or someone you might know, feel free to reach out to us at Claret.