Investors are often tempted to time the stock market – that is, sell when they anticipate a drop to buy back at a lower price. However, historical analyses have shown that this “buy-low-sell-high” strategy performs poorly and can lead to significant losses. So why do some people continue to try (and fail) at timing the market?

Emotions play a significant role in our financial decisions. Fear, uncertainty, and especially greed can influence investors to buy and sell frequently. However, when we look at the data, it is sometimes better to have fallen into a coma and have done nothing to obtain an adequate return. Those who try to sell before a market decline usually watch the train go by when the decline occurs and buy back much too late, if ever. In the long run, staying on the sidelines means you will probably miss out on significant returns.

Let’s look back at some Dow Jones statistics between 1901 and 2018.

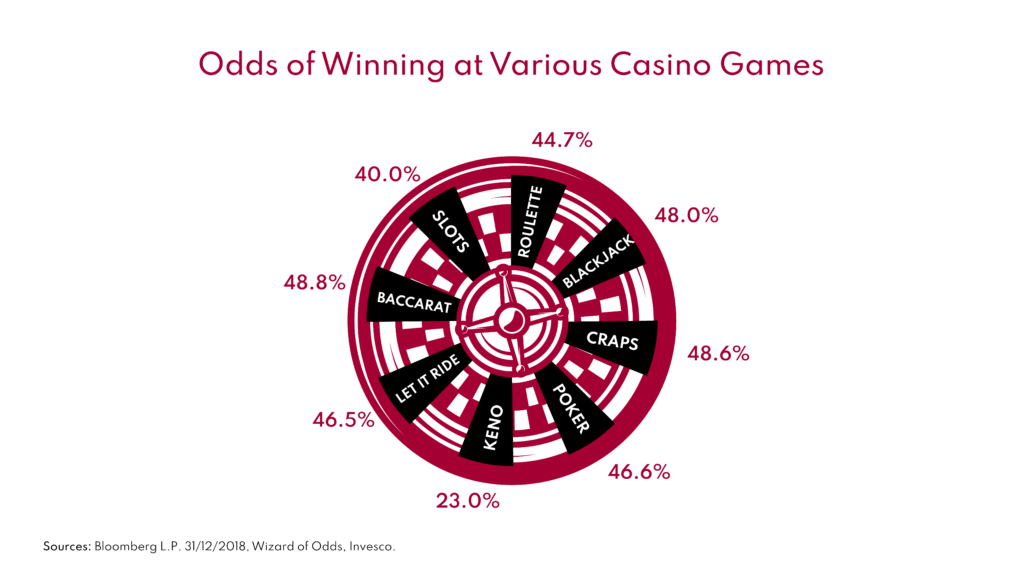

Unlike a casino, where all games favour the house, the more one invests over the long term in the stock market, the more one significantly increases the probability of making gains. This is a strong argument for those who consider the stock market and casinos or games of chance to be the same.

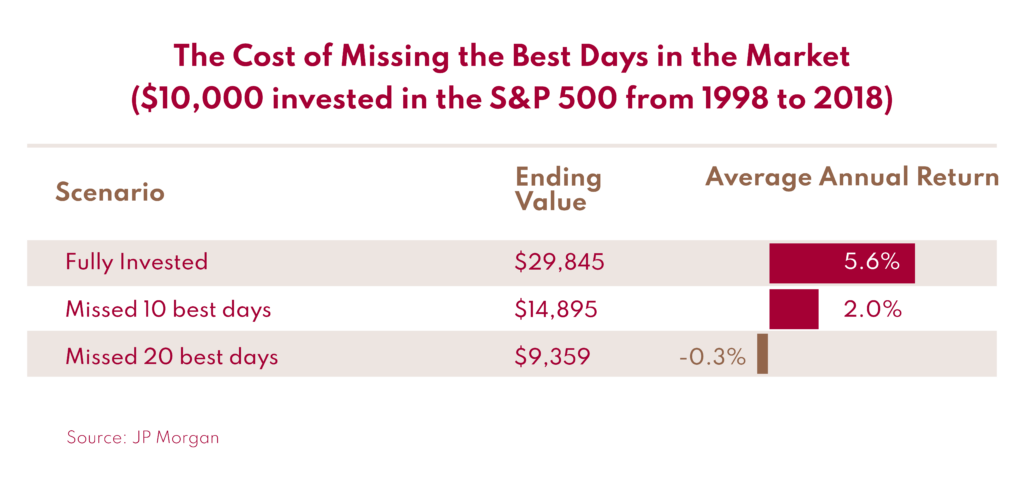

Additionally, it can be highly costly to miss just a few days on the stock market. Even if you predict a decline ideally, the timing must be perfect to obtain a higher return than someone who would have done nothing or remained invested.

One study on this subject is that of JP Morgan, which highlights that an investor who missed only the 10 best days of the market between 1998 and 2018 would have seen his return halved compared to the S&P 500 index during this period.

And missing the 20 best days would have even led to a negative return, while the S&P 500 would have generated an annual compound return of around 5.6%.

Other studies confirm these results, including one carried out by Claret in 2008, which you can find here.

When it comes to investing, time is your friend. The longer your investment horizon is (and by long, we mean a minimum of 5 years), the greater your chance of making money. Adopting a buy-and-hold mentality and a solid methodology will help you navigate times of uncertainty.