What a quarter! Stock markets have finally experienced their first 10% correction since the beginning of 2003. An apparent liquidity crisis developed in the asset-backed commercial paper money market, triggering a sell-off in most of the stock markets globally.

The Federal Reserve immediately came to the rescue by cutting interest rates by 50 basis points and equity markets responded by gaining back all of their losses as if the world was now back to normal. Could it really be that simple?

The following table summarizes the price performance of the main indices for the third quarter and the first 9 months of 2007.

| Third Quarter | First 9 months | |||

|---|---|---|---|---|

| In local currency | In Canadian Dollars | In local currency | In Canadian Dollars | |

| S&P/TSX (Cdn) | +1.38% | +1.38% | +9.22% | +9.22% |

| S&P 500 (US) | +1.56% | -5.41% | +7.65% | -8.38% |

| Nasdaq (US) | +3.77% | -3.34% | +11.85% | -4.80% |

| Europe (EUR) | -3.88% | -5.67% | +3.14% | -5.10% |

| Nikkei (Japan) | -7.46% | -7.51% | -2.56% | -13.98% |

There are numerous uncertainties in the U.S. outlook, and the top of the list is whether the economy faces a recession. While many believe that it has already begun, we are more optimistic that a recession can be avoided. To paraphrase Mark Twain, “rumors of the death of the US economy have been greatly exaggerated”. It is certainly not in the best of health, but it should muddle through with a protracted period of sluggish growth.

There is no doubt that the housing sector will face a painful multi-year adjustment, with home prices declining in real terms and housing permits continuing to fall for the foreseeable future. Although historically, there has been a loose relationship between household wealth and personal savings rate (i.e. people save more when they loose money on their house), the main determinant of consumer spending is the trend in employment and income both of which seem to be stable.

While U.S. domestic demand will remain under pressure, the bright light in the horizon is the net trade picture. Thanks to a much weaker US dollar and the strength of the global economies, export volumes are expanding at three times the pace of imports. Meanwhile, import growth has slowed due to softness in domestic demand.

As for Canada, we are flabbergasted by the spectacular performance of our Loonie. Despite our bullish bias on the Canadian dollar over the last 3 years, not even in our wildest dreams could we have seen this rally coming: 30 years of decline recouped in a short period of 5 years. Nothing short of a miracle!

However, the ensuing economic consequences of this dramatic change have not been tallied yet and we believe that there will be some major dislocations in the coming years, specifically in the manufacturing and the export sectors, as companies will have to adjust to the new realities of a strong dollar. Some anecdotes have come to our attention to highlight our point:

· A Canadian chemical company that has signed a 5-year contract to supply a US client in 2002 (based on the exchange rate at that time) would probably prefer not to receive new orders as it would most likely be losing money based on the negotiated selling price (in US dollars) versus today’s production cost (in Cdn dollars);

· A Canadian steel structure company now has to compete with US firms in bidding for work, even in Canada, whereas 5 years ago, it would have been an automatic win due to the weak Cdn dollar at the time.

Oil prices keep moving higher and are reaching US$ 87.00 a barrel. The main drivers of this increase are geopolitical, strong demand from Asia and weakness of the US dollar. As mentioned in the last quarterly comments, oil prices still have not reached their all time highs on an inflation-adjusted basis.(Lower to Mid $90 US dollar range).

Judging by the number of phone inquiries and conversations with our clients, we believe it is a good time to reiterate the 3 requirements all investors must accept when investing in equities:

1. We are in for the long haul, i.e. 5 years or more;

2. Unexpected and possibly disruptive events will and do happen, which we will overcome as unemotionally and rationally as possible;

3. We must have a consistent, proven strategy over the long term and we must adhere to it in a disciplined manner even though we know that in the short term it may not always outperform the market.

Let us elaborate on each of these 3 requirements by giving you some insights and hopefully convincing you that equities are by far the most profitable way to invest your money in the long term.

1. After many years experience in client interactions, we know that fluctuations in market values tend to affect investors irrationally. They tend to think that daily fluctuations actually change the value of their wealth, as if they have to sell their investments at the end of each day. For instance, when a person purchases a home, either to live in or for investment purposes, they rarely call their real estate agent to check what its market value is the next day. Yet investors often do this when it pertains to their investment portfolio. When asked to explain this behavior, the answer is something along the line of: “real estate is different” or “I bought it for the long term” or better yet “people don’t lose money in real estate”. We should ask the speculators who recently purchased condos in Florida how they feel about not losing money.

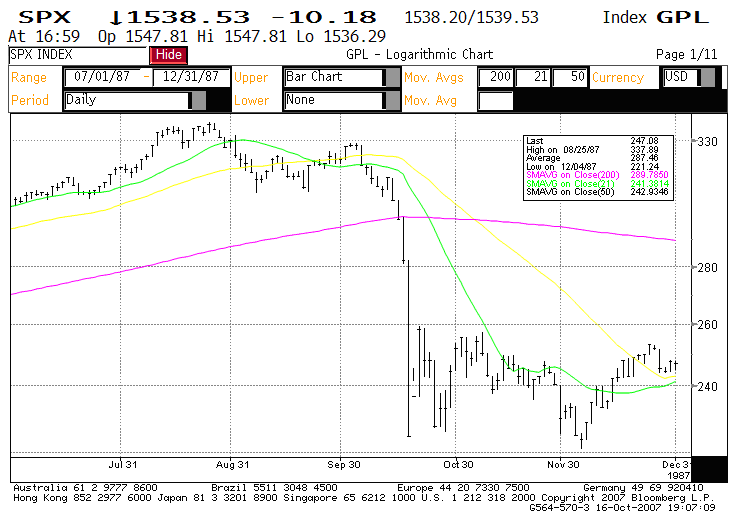

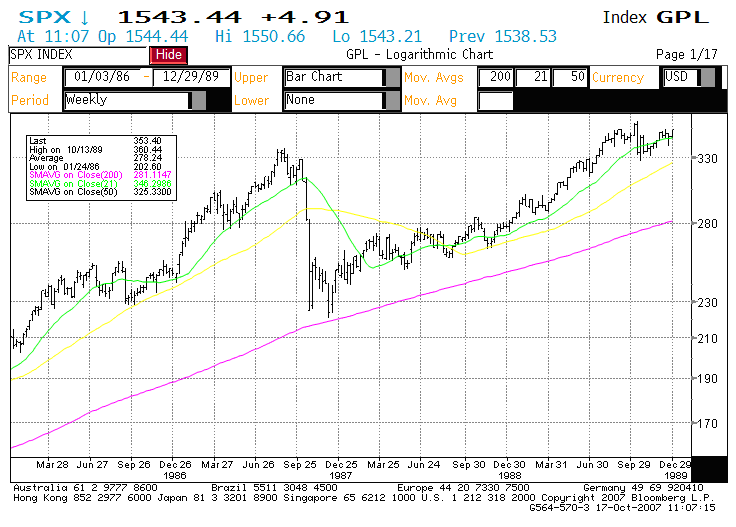

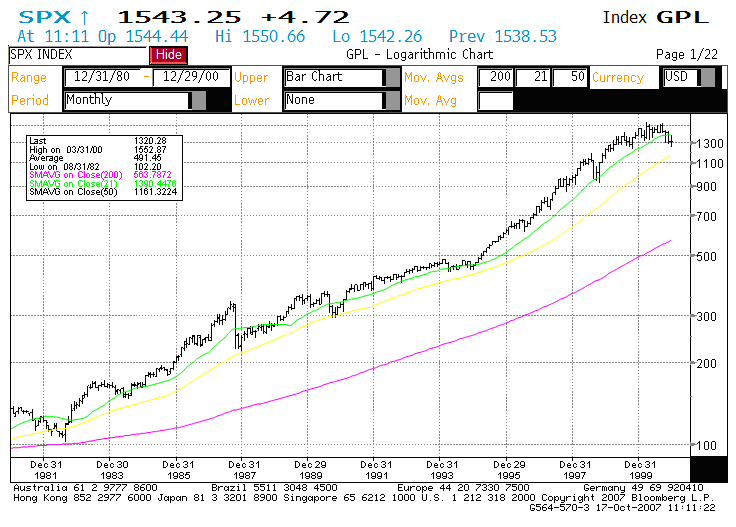

Our point is that if you look at a longer period of time, the intermittent fluctuations are only noises that, if adhered to, will throw you off your long term goals. To illustrate, let’s look at the crash of 1987 in 3 different ways, as represented by the following graphs of the S&P 500:

From July 1st,1987 to December 31st,1987 on a daily basis:

Now, from January 1st, 1986 to December 29th, 1989 on a weekly basis:

And finally, from December 31st, 1980 to December 29th, 2000 on a monthly basis:

As you can see, as violent as the 1987 correction was at the time, it only shows up as a blip if we look at it within a 20-year period. Therefore, having a long-term horizon is essential when investing in equities. It removes the “panicky” feelings that daily or weekly fluctuations can create and it allows us to keep our eyes on our longer term goals.

2. As for unexpected and disruptive events, let us just name a few of them in the last 40 years:

· 1966: The Viet Nam conflict; US bombs Hanoï;

· 1971: Nixon devalues the US dollar; end of the Gold Standard;

· 1974: Oil embargo and Nixon resigns;

· 1979: Iran hostage crisis;

· 1981: President Reagan shot;

· 1985: US becomes debtor nation;

· 1987: market crash;

· 1989: junk bond market collapses and Savings and Loans bail out;

· 1991: Gulf War;

· 1993: first World Trade Center bombing;

· 1995: Oklahoma bombing;

· 1998: Asian economic crisis spread, oil prices plunge and Russian default;

· 2000: technology bubble bursts;

· 2001: September 11, terrorist attack on US; America strikes back and invades Afghanistan;

· 2003: US invades Iraq;

· 2005: Hurricane Katrina slams Gulf Coast; record damage and record losses for insurance companies;

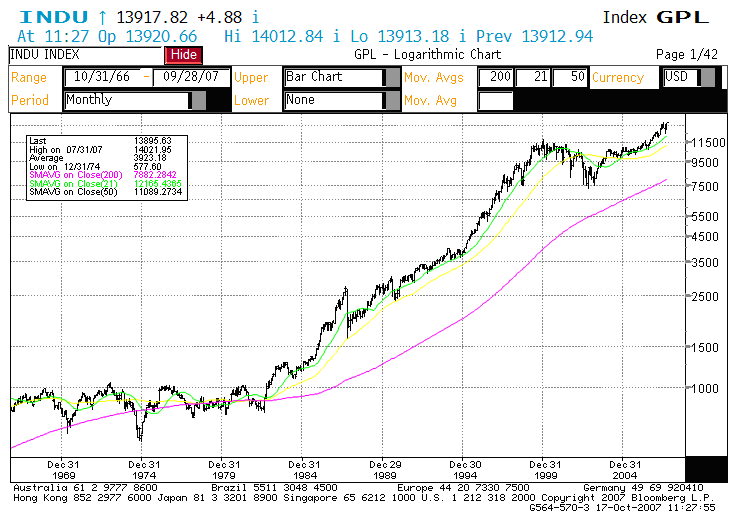

Every couple of years, a major event happens and captures the attention of the media. Through the efficiency of our communication systems, such as the internet, and the marketing skills of reporters, emotions sometimes spread like wild fire and create havoc in the financial markets. Yet, throughout the 40 years of history shown below, the Dow Jones still managed to post an average annual return of 11%. In dollars terms, US$1 invested in October 1966 is worth US$ 74.00 today. In other words, if investors ignore the noise, remain calm and do nothing but stay invested, a 10% return over the long term is not unrealistic. However, when panic sets in, adifferent story is almost assured (this will be a topic for a different day).

3. At Claret, our investment strategy is highly quantitative, i.e. we believe in mathematics (basic arithmetic and lots of probabilities). We try to avoid making conclusions based on management presentations with lofty expectations. Our objective is to be as rational as possible and to stay away from being influenced by salesmanship (which is what all management does and does it very well).

Consequently, as a supplement to our stock selection process, our research efforts have been directed towards computer screening of market data in order to find strategies that have worked well in the past on a long-term basis. We don’t want you to think that we have reinvented the wheel. In fact, as an example, we can find hundred of academic research papers throughout several decades that have indicated that value strategies have outperformed growth strategies on a long-term basis. Yet, individual and institutional investors show a preference to glamour (growth) strategies over value ones.

One reason is that investors may make judgment errors and extrapolate past growth rates of glamour stocks, such as AOL or Yahoo, even when such growth rates are highly unlikely to persist in the future. Putting excessive weight on recent past history is a common judgment error in psychological experiments, and not just in the stock market. Moreover, lots of individuals think that well-run firms are good investments regardless of price. This is the “how can you lose money with IBM” phenomenon.

Another important factor is that most investors have shorter time horizons than are required for value strategies to consistently pay off. This is what we would call “what have you done for me lately” behavior. Most people look for stocks that will outperform within the next few months rather than over the next five years. Institutional investors are even worse due to the pressure from their sponsors. A value strategy that takes 3 to 5 years to pay off but may underperform in the short term could be very risky for the managers’ career. Therefore, for fear of getting fired, they might not want to choose the value strategy.

We cannot emphasize enough the importance of being disciplined, consistent and above all, unemotional in our investment process. It is true that it is extremely difficult to be immune to all the noise around us, especially when lots of very bright reporters are paid very well to feed us the information that is designed to trigger emotional reactions. In the financial markets, fear and greed are triggered everyday (just watch Squawk Box or Mad Money and you will know what we mean). Therefore, we believe that quantitative models based on value are a good refuge for investors and helps them focus on their longer term goals during turbulent times.

We certainly hope these comments will help you keep a long-term perspective when viewing your investment portfolio and will convince you that our value biased strategy is the right one on a 5 year basis, notwithstanding some underperformance in the short term.

Claret