“When the Time Comes to Buy, You Won’t Want To” (Doug Kass)

It only took a little virus to put an end to the “flawless decade long” bull market. Then, we realized how connected the whole world is thanks to the globalization of trade, communications and transport. Countries started imposing travel restrictions, lockdowns to contain the spreading of the disease. WHAT DO WE KNOW? Regarding the status […]

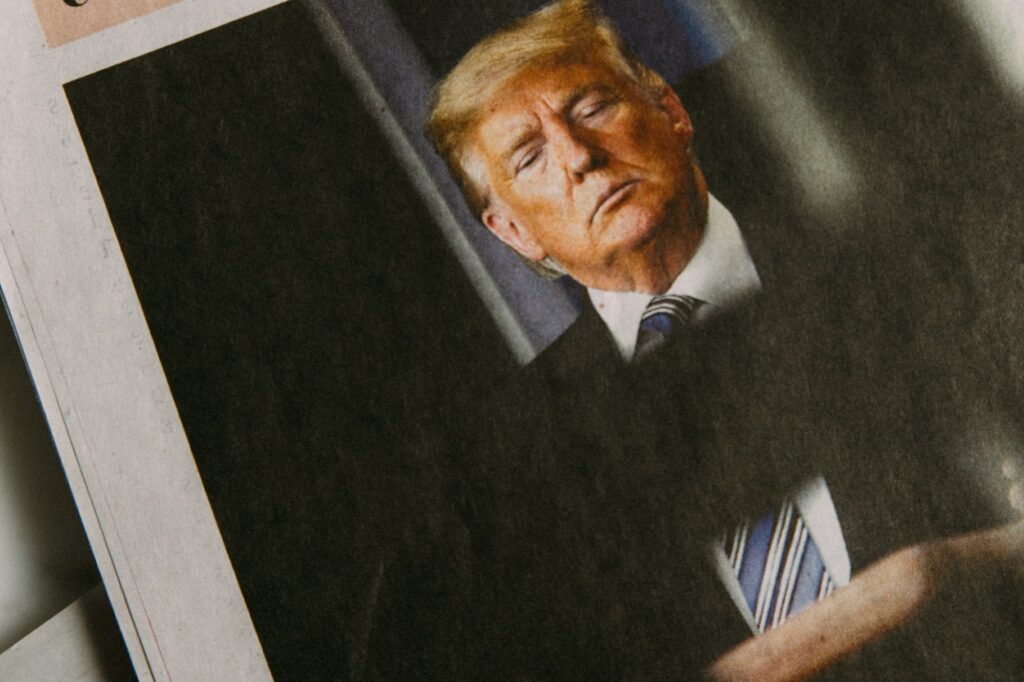

Does Donald Trump influence your investment decisions?

Donald Trump’s comments on Twitter can have a significant short-term impact on the US stock markets, but should you follow them?

Does it pay to buy when a company goes public?

In a nutshell, if you want to play the game, your best bet is to remain diversified.

A Glimpse of Markets as we See Them Today

Following an abysmal 4th quarter of 2018, equity markets rebounded with the biggest quarterly gain since the third quarter of 2009 and the best first quarter since 1998. As we have been emphasizing over and over, equity markets manage to sustain a valuation level (i.e. price/earnings ratio) that seems high relative to the last 40 […]

Observations from 2018, Optimism for 2019

As 2019 starts, the market continues its gyrations that began in September 2018. Volatility has indeed increased over the last 3 months but only relative to the last 2 years where it has been quite subdued. We go back 100 years (i.e. since 1920) and look at the day-to-day and intraday volatilities and our conclusion […]

Resolution ideas for investors to start the year off right

As the 2018 begins, should investors adopt resolutions to better manage their investments?

Pros & Cons of Robo-Advisors

Most robo-advisors have the perks of being cheap and relatively easy to use. But, would you rely solely on them when it comes to making important investment decisions? Vincent Fournier, Portfolio Manager at Claret, believes that receiving good advice from a real investment professional will prevent you from making unnecessary mistakes. Watch this French interview on Les Affaires