Initial public offerings, or IPOs, will be the name of the game in 2019, with several popular names going public, just as Uber did at the beginning of May. Beyond Meat, known in Canada for its plant-based burgers sold at A&W, recently decided to jump on the bandwagon, generating a lot of interest: it’s share price rose 163% on its first day, becoming the most lucrative IPO in 10 years. An investor might wonder whether it’s worthwhile to take part in these new issues.

Below are the results of a study¹ conducted on IPOs in the United States between 1980 and 2018:

- The average yield of shares at the close of their first day of trading was 17.9%. However, it should be noted that it is extremely difficult, if not impossible, to buy these shares at their issue price because banks distribute them to their largest institutional clients before making them available to individual investors.

- If an investor bought a security at its first day closing price and held it for 3 years, their average annual return would be 6.8% – well below the market return of 11.2% over the same period of time².

- There is a significant difference in the performance of companies based on size at the time of their initial public offering. The largest companies ($1 billion in revenues and up) tend to have a much more modest performance on their first day on the stock market, which is something that can subsequently prove very interesting. The opposite holds true for the smallest companies.

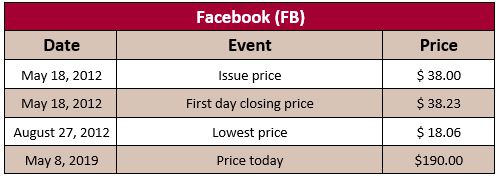

So, if it is hard to make money without having paid the issue price, what can investors do? Be patient, that’s what! Facebook is a perfect example. As can be seen below, an investor could have purchased shares at a much lower price just by waiting a few weeks:

Now, obviously, this isn’t always the case. There have been several fewer sterling examples, such as Snapchat, Lyft and Spotify. In a nutshell, if you want to play the game, your best bet is to remain diversified.

The Claret team

¹Initial Public Offerings: Updated Statistics – Jay R. Ritter, Professor of Finance, University of Florida, April, 2019

²S&P 500 total return in USD