What a difference a quarter can make! We are now back to the same stock market levels we started with before the spring correction we alluded to in our second-quarter comments. Markets are definitely climbing a wall of worries, considering that it would be next to impossible to find someone who is not aware of all the economic and social problems we are facing today. It is actually very difficult to find any “experts” (economic, finance or otherwise) who are not bearish or at the least cautious about the future of America, or Europe, or both.

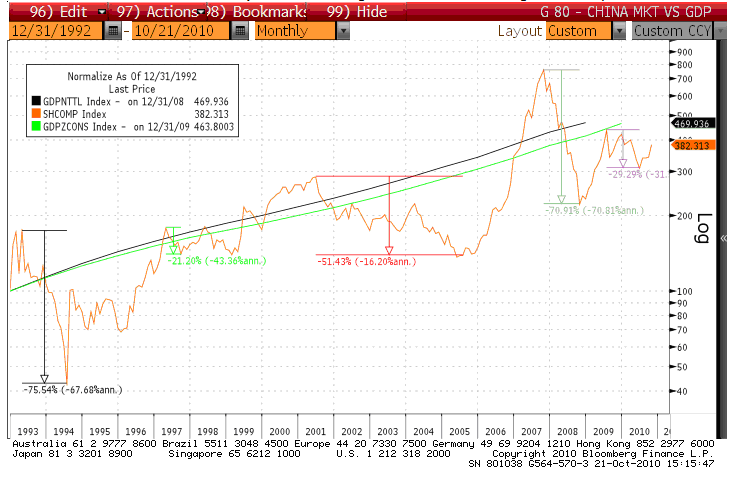

Meanwhile, these experts all seem to agree that emerging markets are the place to be and that these markets will drive future global economic growth. Judging by the forecasted growth rate of these emerging countries (BRICs and other), it is difficult to contain one’s enthusiasm. Yet, most people don’t realize that while these forecasts could turn out to be accurate in the long term, it is far from certain that the stock markets in these countries will behave as predictably as the forecasters would like them to, especially in the short term. The following chart illustrates fairly well the “disconnect” phenomenon in the short term between stock markets indices and economic growth:

The black and green lines represent the GDP and the GDP per capital of China since 1993 while the orange line represents the Shanghai stock market index. As you can see, the ride up has been quite bumpy at times, including two 70%+ corrections.

We believe the best way to participate in the emerging markets growth is by owning multinational companies, especially when they are selling at below average multiples. For those of you who have strong stomachs to handle the volatility, exchange-traded funds (ETFs) and selective Chinese companies listed in the US markets can be included.

You all know by now that we use a bottom up approach in our analysis. As we screen through our universe of stocks, we seem to find more undervalued stocks in the US markets. The main reason for this observation is probably related to the dismal returns suffered by investors over the previous 10 years by which they extrapolate the bad news into the future and conclude that US stocks are not worth holding. Notice that investors also extrapolated the good news back in 2000 when the internet bubble was in full bloom. Unfortunately, one cannot drive a car by looking in the rearview mirror. It is a sure-fire way to get into an accident.

The investing cycle usually unfolds according to the following scenario:

1. Entering a recession and after a nasty down market, investors are looking to buy safe investments, i.e. government bonds.

2. As bond prices rise, due to an increase demand, investors chasing yields migrate towards corporate bonds.

3. As corporate bond prices rise (yields decrease) and stock markets stabilize, investors start thinking that, for the same yield they can obtain in corporate bonds, they could own equities with a decent dividend yield and with a potential for price appreciation, having the best of both worlds.

4. The cycle then extends and includes more stocks. By now, the economy is showing signs of strength, enough to convince investors that everything is back to normal. The unemployment rate is falling, businesses are booming again and stock markets have locked in decent returns. Investors are now growing more comfortable with equities in general.

5. As the economic boom continues, optimism about the future sets in and more and more investors are interested in concepts and/or innovations instead of the down to earth, boring, stable business ideas. Driven by greed and impatience, they start venturing into more speculative investments. Stock markets are now rising at an increasing rate, reflecting the enthusiasm that the public has for quick return investment strategies, i.e. short term trading and leverage.

6. The whole scenario eventually ends with a sharp drop in stock prices, sometimes dragging the economy into a recession (but not every time).

While it is difficult to pinpoint when a phase begins and when it ends, our guess is that we are now somewhere between phase 2 and 3. This can be verified by asking yourself the following question: if you had some cash to invest now, where would you invest it?

We are bullish on stock markets overall in the longer term, believing that the US economy will recover, led by human ingenuity and a desire to better one’s standard of living over time. Questionable government policies enacted by politicians are of course a hindrance, but global capital flows and hopefully democracies will eventually dictate that bad policy makers get thrown out of power and good ones get elected. Ronald Reagan and Margaret Thatcher come to mind.

Human beings usually start thinking about a solution only when they know there is a problem. For some time, most people did not believe they were incurring too much debt. They kept on spending like drunken sailors, using their houses as ATM machines and believing that the increase in price would cover the additional debt incurred. Then the unthinkable happened: the housing market collapsed. Now, they realized they had a problem and started looking for a solution. Inevitably, they will find out sooner or later (if not already) that the only viable solution is to work and save. We are already seeing the savings rate in the US rising. As this trend continues, the economic picture will improve over time. If you believe that the US economy will be healthier 5 to 10 years from now, it is difficult to justify a bearish stance since stock markets will discount the good news along the way and will rise. We just don’t know by how much and how fast, but the direction is fairly clear to us.

The Claret Team