Every spring, millions of Canadians sift through their T4 or RL-1 slips and then pause at a line that often raises eyebrows: Pension Adjustment (Box 52 in your T4 or Box D in your RL-1). It’s usually a large number, and for many taxpayers, the same two questions come up: What is this? Where did it come from?

What a Pension Adjustment Really Is

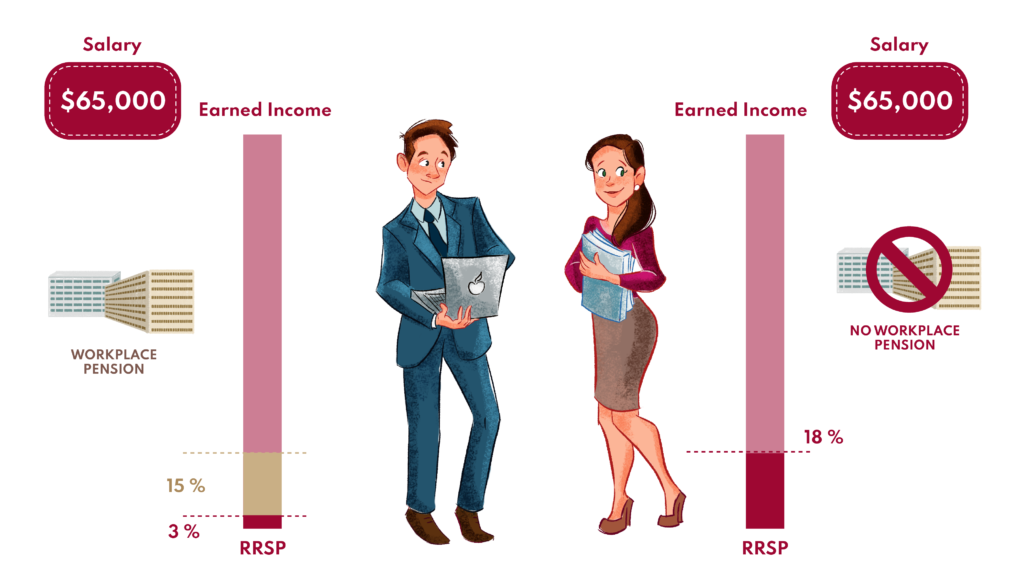

A Pension Adjustment (PA) represents the value of the retirement benefits you accrued through a workplace pension plan or a deferred profit-sharing plan in the year. It’s the Canada Revenue Agency’s (CRA) way of tracking how much tax-assisted retirement savings you’ve already accumulated through your employer-sponsored plan.

This number is not included in your taxable income, and it’s not a tax you pay. It’s simply an accounting measure that reduces the amount of new RRSP contribution room you will have for the following year, since you’ve already built retirement savings inside your pension.

In other words, it ensures fairness between people saving through workplace pensions and those saving only through RRSPs.

What is a LIRA? Why It Matters

Here’s the part many Canadians overlook: if you’ve ever left a job with a pension, the value in that plan may have been transferred to a Locked-In Retirement Account (LIRA), or a locked-in RRSP.

A LIRA is a tax-deferred investment account that holds money coming from a former employer’s pension when you change jobs or retire. These funds are “locked in,” meaning withdrawals are restricted until retirement (except in very specific situations). The goal is to make sure this money is preserved for your future income.

Too often, LIRAs are:

- left in default, low-growth investments

- forgotten after a job change

- treated as “set and forget” accounts.

That’s a missed opportunity.

A LIRA can be one of your largest retirement savings buckets, and proper management can significantly boost your retirement savings. Just like an RRSP, it grows on a tax-deferred basis, and you have a wide range of investment choices to align with your goals, risk tolerance, and time horizon.

How to Maximize Your LIRA

1. Review What It’s Invested In

Default investment options are often very conservative and may be unsuited to your investment profile compared to well-balanced portfolios over long horizons.

2. Consider Consolidation or Rebalancing

If you’ve changed jobs more than once, you might have multiple locked-in accounts. Consolidating them can simplify your finances and make it easier to manage a single, coherent strategy.

3. Understand Withdrawal Rules

LIRAs have strict rules. In most cases, you cannot access the funds until they are converted to retirement income at retirement age, except under specific conditions that vary by province.

4. Integrate it into Your Broader Plan

Your LIRA shouldn’t be managed in isolation. Its investment mix should complement your RRSPs, TFSAs, pensions, and other assets to create a coordinated retirement strategy.

5. Talk to a Financial Advisor

A professional can help you choose the appropriate investments, plan future conversations about income, and optimize taxes and withdrawals as part of your overall retirement plan.

The Bottom Line

A pension adjustment isn’t something to fear. It’s simply the CRA’s way of recognizing the retirement savings you’ve built through your employer. What does deserve your attention is the retirement capital behind that adjustment – especially any money now sitting in a LIRA. Managed thoughtfully, that locked-in account can become a powerful engine for your retirement income rather than a forgotten, underperforming pot of money.