Becoming a millionaire seems like a far-away dream, which only happens to the very lucky. However, I will share a not-so-well-kept secret: Becoming a millionaire in Canada has actually never been easier.

In the video above, I explained how you can leverage the two main current Canadian investment vehicles to become a millionaire by the time you retire. However, I only explained an ideal scenario, where you start to save as early as 22 years old.

Now, let’s look at the numbers if you start saving at 30 or 35 years old – a more realistic scenario for most Canadians. The good news is, that even if you only begin saving in your 30s, you can still set yourself up for success in retirement.

How to Become a Millionaire in Canada with Your TFSA and RRSP: How They Work

The TFSA currently allows you to contribute $6,500 per year (as of 2023). You do not get a tax deduction when you contribute money into the TFSA, but you do not pay taxes when you withdraw money.

The RRSP allows you to contribute up to 18% of your salary per year, subject to an annual limit of $162,278.00 in 2022. You get a tax deduction that reduces your taxable income, but your withdrawals will be taxed as income when you take money out.

To keep it simple, we will not take inflation into consideration in our numbers and assumptions. Inflation definitely complicates things – but that’s a video for another day.

Scenario 1: Starting at 30 Years Old

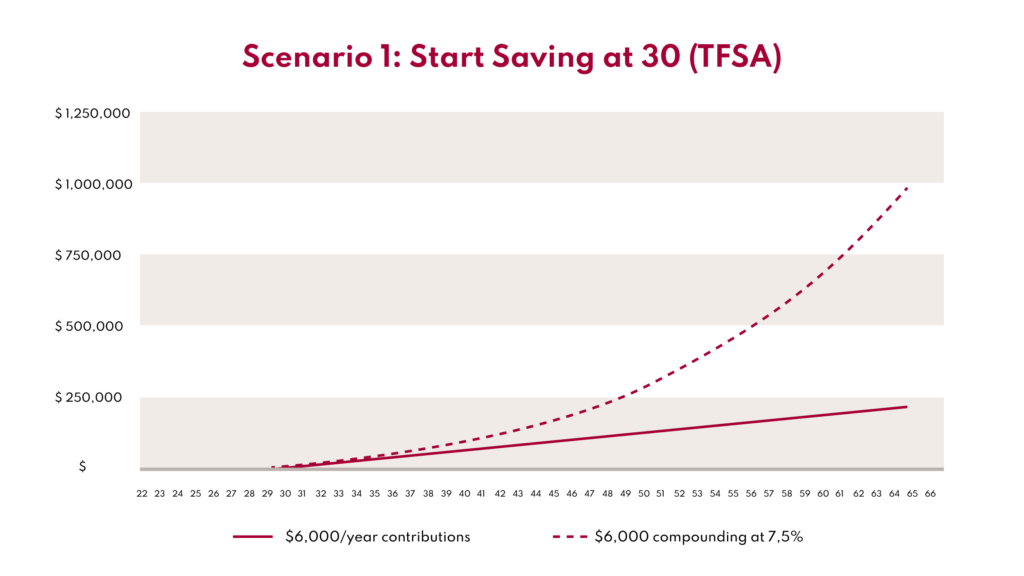

Let’s say you start saving at 30 years old. Every year, you contribute the $6,000 yearly maximum to your TFSA, and you then invest that money in a Pooled Fund or an ETF, up until your last contribution, when you are 65 years old.

When you reach retirement, you will have contributed $216,000. Using the “magic” of compound interest, you will need an investment performance of 7.5% per year for your TFSA to be worth over a million dollars, as you can see in our first graph below.

A return of 7.5% per year does involve taking on more risk, but the US and Canadian markets have historically made this very feasible.

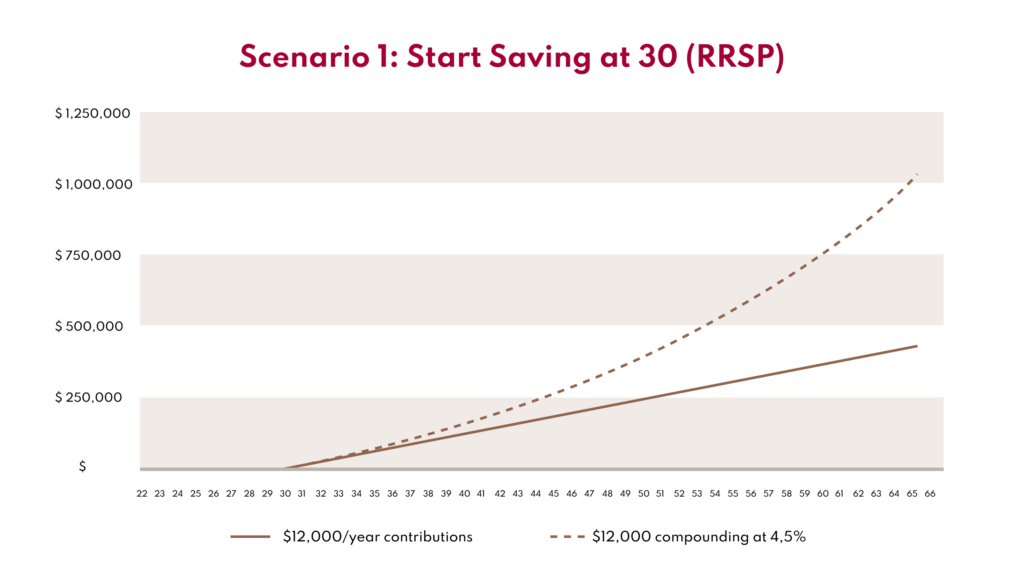

If you want to greatly increase your odds, you should also contribute to your RRSP. Let’s say that in addition to your TFSA contributions, you are able to contribute the same amount of $6,000 per year in your RRSP as well. Combined with your TFSA, you will have contributed $432,000.

As you can see below, by making regular contributions, you only need an annual return of 4.5% per year to grow your contributions and retire as a millionaire.

Scenario 2: Starting at 35 Years Old

What if you only start saving at 35 years old? After all, it takes time to pay off things like student debt; many Canadians don’t have cash leftover to squirrel away until they are in their mid-30s.

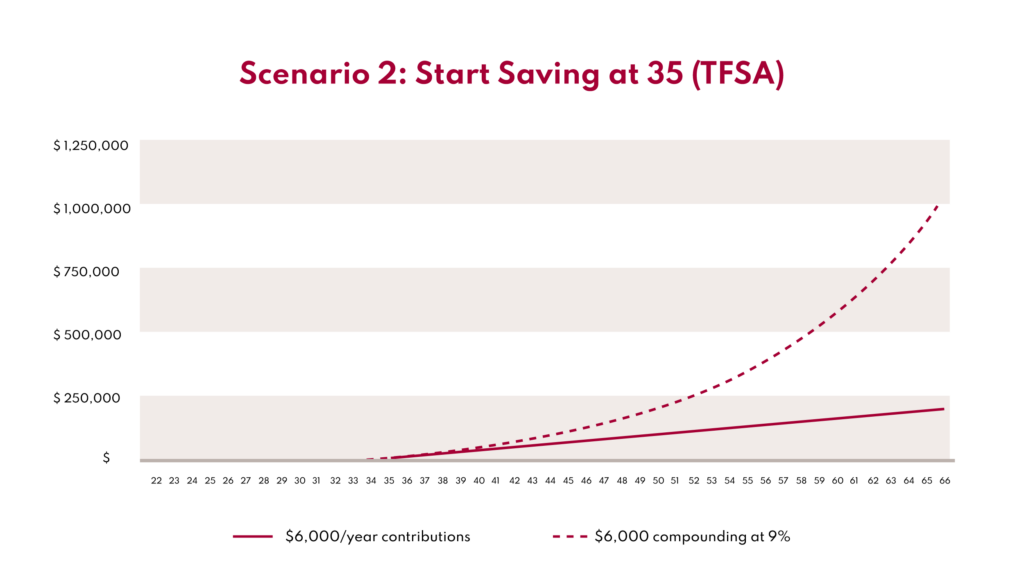

The good news is that becoming a millionaire by retirement is still feasible, but your TFSA alone will not be enough. By saving $6,000 in your TFSA every year, you will put aside a total of $186,000 by age 65. With an annual return performance of 9% per year, you will come up just shy of $900,000, as you can see in our third graph below. Not bad!

That annual return of 9% is loosely based on the US stock market’s average annual return for the past 100 years.

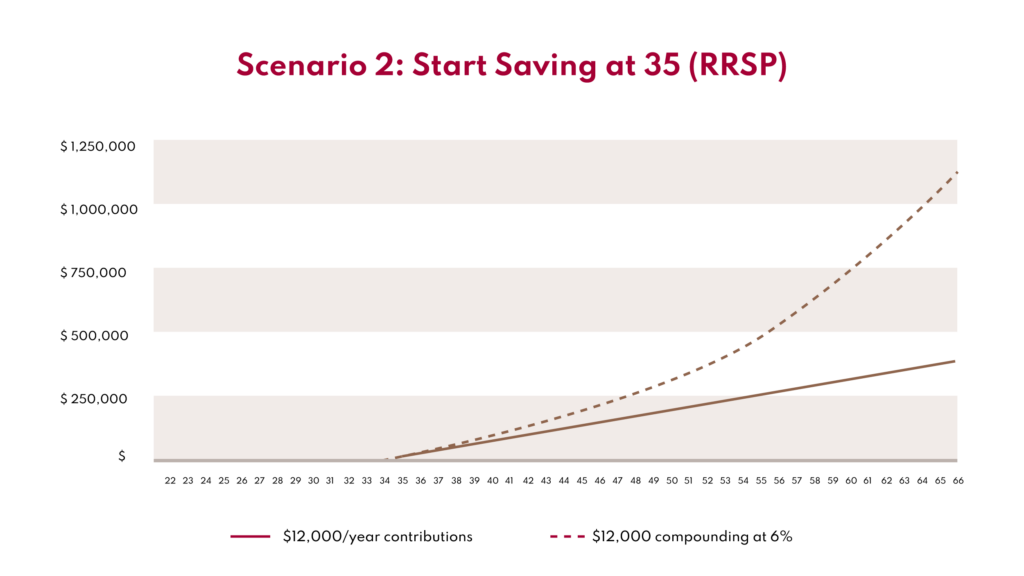

However, if you want to hit the millionaire mark, you’ll want to save an additional $6,000 to your RRSP. With your total savings of $372,000, let’s assume a more reasonable portfolio performance of 6% per year, which would get you to a total of about 1 017 000 $:

For those who have watched my video explaining how investment income is taxed in Canada, you can understand how powerful the TFSA and RRSP are since they allow you to avoid (or defer) paying a huge amount of taxes.

Keep in mind, that “one million dollars,” while tantalizing, is just a number. Instead, focus on your own needs and consider what you want your retirement future to look like. Not everybody will need the same amount at retirement and not everybody can take the same amount of risk in their portfolios. However, with the right investment plan and leveraging Canada’s tax-free investment vehicles, you, too, can become comfortably wealthy by the time you reach retirement age.