What triggers a financial bubble – also known as economic bubbles or speculative bubbles – may vary from one time to the next, but they’re generally characterized by the same five stages. Using the example of one of the earliest known financial bubbles, Tulip Mania, here are the five stages of a financial bubble, from the moment it begins to form until it bursts.

1. Excitement

This is the stage where people fall in love with a new product or technology. It is also very often a time of major change in the economy. In the case of the tulips in Holland in the 1600s, the country was experiencing strong economic growth due to the boom in international trade. Since tulips were rare, took a long time to grow, and most importantly were seen as a symbol of wealth, they were the perfect candidates to drive the Dutch people to a frenzy.

2. Boom

During the excitement phase, prices begin to rise, but only modestly. During the boom phase, as more and more buyers want to join the party, prices increase, but exponentially. This is usually the phase where the mainstream media begins to cover the topic and “ordinary” people begin to take an interest. We see the first signs of a financial bubble, with behavioural biases like “The Fear of Missing Out (FOMO).” This where speculation really takes off.

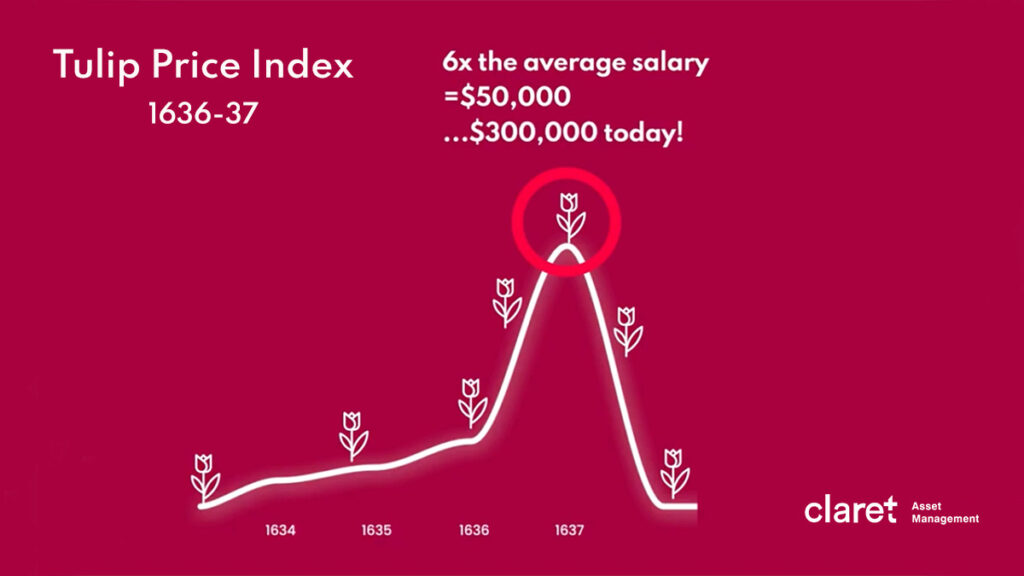

In the case of tulips, although they arrived in Holland at the end of the 16th century, the real boom took place between 1634 and 1637.

To fully understand the boom phase, we just need to remember how the dynamics of supply and demand work. If demand for something new increases very rapidly and supply remains stable, theoretically, prices should rise. The more pronounced the effect, the faster prices will rise.

3. Euphoria

Here’s where caution is thrown to the wind and asset prices soar. Investors have made so much money on their investments that they can’t imagine values going down, and they tell all their friends. This is the phase where your uncle, your neighbour, and your cab driver are telling you to get in on the action. People who buy during the euphoria phase don’t realize that the only way to make money is if someone else decides to buy after they did – also known as the Greater Fool Theory. But who’ll be your next buyer if everyone is already in on the game?

Unfortunately, this is usually the phase where small investors are the most heavily hit. During the tulip frenzy, peasants wanting to get rich quickly went so far as to sell their house, their land and use all their savings in order to acquire a few or even a single tulip bulb. These are the people who lost everything.

4. Profit Taking

Could a single tulip bulb really cost $300,000? As I explain in the video above, this is the approximate value at which a very rare tulip bulb could be sold in Holland at the time, in today’s dollars. During this phase in the financial bubble, wiser investors begin to realize that the price increase is not sustainable, and so they sell their assets. Going back to our tulips, the dealers who held the auctions for the public were the first to realize that demand was rapidly dwindling and were the first to sell their tulips. In today’s market, institutional investors have some of the same information as the dealers had then, because they know who is buying what and who is selling what…

5. Total Panic

When people realize that everyone is selling, panic sets in and there’s not much left to do. Let’s say you were in line to get into Disney World and you saw a swarm of panicked people racing out of the theme park. How would you react? You would probably start running like everyone else. When panic hit the general public in 1637, the price of tulips collapsed within months, and those who had bought at top prices had to sell for less than a quarter of what they paid.

Protect Your Investments From Financial Bubbles

Today, Holland is the world’s largest producer of tulips, producing up to 3 billion bulbs a year, the lion’s share for export. The financial bubble may have burst, but it did lead to the birth of an industry that remains important for the country to this day.

If you dig around a bit (pun intended), you can buy 100 tulips today for about $150… They may not be as beautiful as a Semper Augustus of the era, but you’ll still get 100 bulbs for a fraction of the price, 400 years later.

Financial bubbles will continue to form and grow and burst because they are driven by human behaviour more than anything else. Although technology has changed a lot since the Dutch Tulip bubble, our behaviour hasn’t changed much.

Indeed, each of the two financial bubbles that followed (described in the video embedded above!) generally followed these five stages. Don’t hesitate to contact me, or do some research on your own if you want to learn more. All three financial bubbles are fascinating in their own right.

Bottom line? Keep an eye out for bubble-like conditions, have a good asset allocation strategy, don’t let greed cloud your judgment, and remember to analyze the crowd effect.