Forecasting…Do you actually need it to be successful?

The third quarter was quite brutal for the stock markets around the world. Most indices were down double digits, oil prices hit the high 30s and the global economy seems to be slowing down. Most blame the Chinese economic slowdown and its possible contagion throughout Asia. Others blame the Yuan depreciation and the threat of competitive devaluation. Whatever the reasons, we think it is just a normal adjustment (we would say a correction) after 6 years of bull markets with 1 or 2 minor corrections. The US economy seems to be humming along with the unemployment rate at a low 5%. China, despite a slowdown, is still growing at somewhere between 4 and 5%. The most important aspect of the Chinese economy is that it is moving slowly away from an export-based manufacturing economy towards a consumer-based one. The main consequences are lower demand for commodities which impact economies like ours and Australia. However, low commodities prices have always done more good than harm to global economic growth.

*******************************************

For those who did not attend our recent series of presentations, here is a summary of the ideas we have communicated:

- We, humans, despite the lack of strength versus other animals, such as claws for self-defense, speed for escape etc…, have survived over the centuries thanks to our quick reactive minds. We are programmed to detect trends in nature: when the temperature changes, we get ready for colder weather; we harvest food and store it for less clement climate. We are also programmed to respond to threats and opportunities: for example, in unfamiliar territories like jungles or forests, we run if we hear a sudden noise. In order to help us survive, we have learned to organize and prepare for all situations. For this, we have learned to make forecasts, mainly regarding the weather (from hourly to years in advance), since it is the most important aspect to our survival.

- In 1814, Laplace, a well-known French mathematician, wrote that 3 conditions are required to be met in order to be able to make a reliable forecast:

- We need to know every element of the universe;

- We need to know their position within the universe;

- Last but not least, we need to know the laws that govern their interactions.

One simple example would be a chess game: we know every piece of the game, every position they’re in on the board and also the rules that govern their interactions. Therefore, with enough computing power, we can predict who will win as the game progresses.

- The question is: similarly to the chess game, is it possible to make a reliable economic forecast? Let’s go through the 3 conditions one by one:

- There are roughly 45,000 economic variables released by the US government every year, over 4 million statistical figures supplied by different private sector participants along with the related “noise” such as the “Super Bowl” prediction and many others. It is practically impossible for anybody to know all these variables;

- As to their positions in the universe, we only have to look at the yearly US GDP forecast to realize that one does not even know the real state of the economy at any point in time: between 1965 and 2009, estimates of US GDP have been revised constantly and with hindsight, by a wide margin: for example, in the middle of the most recent financial crisis, the government’s forecast of US GDP growth was 0.8% for 2008. Subsequently, sometimes during 2009, it was revised downward to -4%. Therefore, at best, we can conclude that we are not sure of our real position within the universe of the economy. In fact, on average, US GDP growth rate estimate is revised + or – 1.7 points over time;

- As to the interactions between all the variables, we can’t possibly know all of them simply because it is mathematically impossible. The number of interactions is an exponential function of the number of variables and when the number of variables gets into the millions…, well you see where we’re going! Worse, we assume these variables are static but they are not; the economy is in constant motion.

As you can see, it’s no wonder why economists can’t systematically make reliable forecasts.

- There are also other problems related to forecasting:

- Extrapolation: for example, in 1894, on the front pages of the Financial Times, it was forecasted that by 1940, there would be practically no more first floors in the London financial district because by then, the horse manure would be piled up over 9 feet high and there was no plan to dispose of it and thus the assumption was made that it would be left on the street. Another example closer to home: the Drapeau administration of the early 1970s, based on the statistics of that time period, decided to build its new international airport in Mirabel. By extrapolating the unsustainable high growth rate of the city at that time, they assumed that by the year 2000, Montreal would have grown all the way to Mirabel;

- The “Black Swan” event: by definition, it is a totally unpredictable event: for example, the 9/11 World Trade Center disaster. Other such events could happen in the future that could alter the course of history but they are totally unpredictable;

- Then there is the “too early syndrome”: remember Jules Verne and his books regarding travelling under the sea? He was right but several hundred years too early, therefore useless for investment purposes.

- Chance is an integral part of forecasting. If you have millions of individuals making forecasts, there is a good chance that somebody will get it right. However, the result is only known after the fact. Not unlike the 6/49 lottery, we all know that there is a winner eventually but there is no way to know whom it will be and when it will happen. To succeed in the business of forecasting, one better forecast often.

- How do all these examples tie back to the financial markets? First, it is important to understand the random nature of short term fluctuations in the markets versus their more steady trending nature of the longer-term outlook. In the short-term, human emotions are driven by fear and greed, whether they are individual investors or professionals, i.e. pension funds and mutual funds managers. We tend to rush into the markets when we perceive we are missing out on a run-up. Yet, we head for the exit as soon as downside volatility increases, as though everything is going to zero. As for the professionals, since their performances are measured on a quarterly basis, they face criticism from their superiors, their clients and consultants and they’re constantly compared to their peers. It is therefore survival for them (i.e. to keep their job) to be focused on the short-term.As a consequence, short-term fluctuations are extremely difficult to forecast as too many variables are involved whereas the longer-term outlook is more steady, thanks to the endless desire of humans to better themselves in all aspect of life, under the right social system (for example, the capitalistic society and its rule of law).

- Since forecasting is of not much use in portfolio management, what choice of strategies should we follow? We have 2 propositions:

- Indexing: this is what Warren Buffett suggests to his family members after his death. This strategy has several advantages: firstly, by buying the entire index, the investor avoids making bad decisions due to incorrect forecasts. Secondly, by buying at regular time intervals, he/she avoids making decisions based on emotions. Thirdly, this strategy infers having a long term vision.

- Or, as we call it, the Claret way: one company at a time. This strategy is also inspired from legendary money managers like Graham, Buffett, Munger, Gabelli and a multiple of others. It is based on fundamental analysis, centered on reading and understanding financial statements. It is about understanding the difference between value and price: price is what you pay, value is what you get. In order to succeed, it requires discipline and patience. It also requires having a long term view as time then becomes your friend.

*******************************************

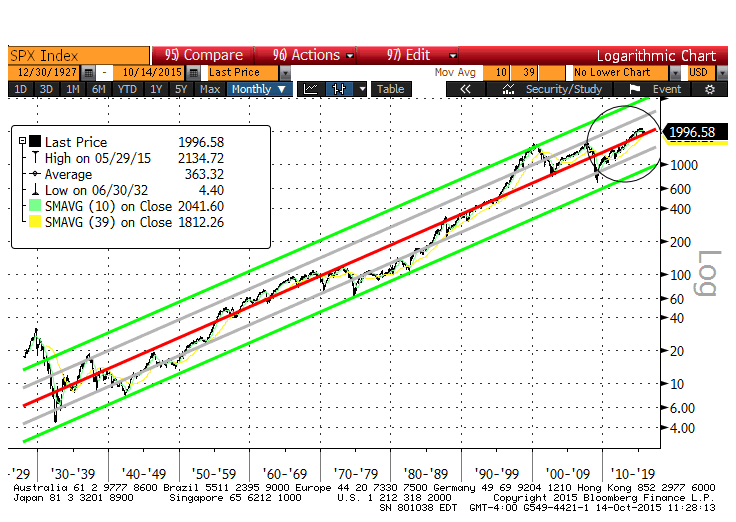

When asked for some feedback after one of the presentations the other day, a client replied the following: “It is quite informative. Now I know you guys don’t know much about the future”. This client is correct! However, in the meantime, although we do not like making forecasts, we are confident that some of you will be asking us what we think will happen the next quarter! For those of you that would like to have a peak into the future, we suggest looking into the past. So let us show you where we think we are within a very long term map (we mean the past 100+ years) that we have updated several times since 2009.

A 100+ year look at the US market (S&P 500)…

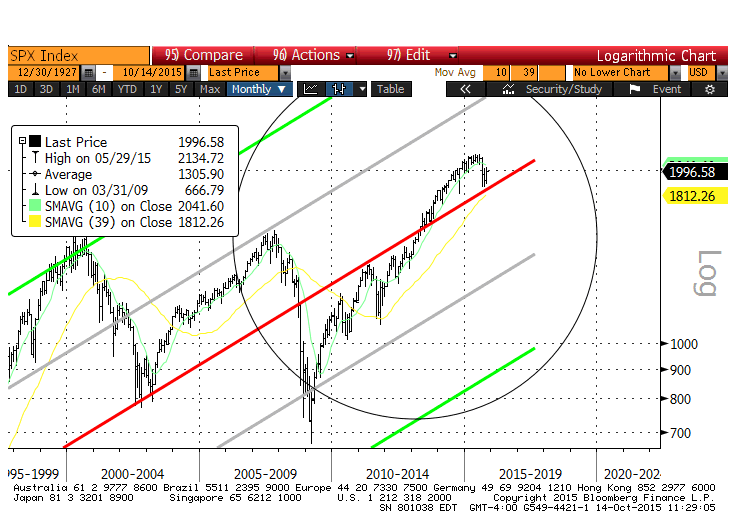

and a closer look…

As we’ve said, it is neither cheap nor expensive. However, since the long term growth rate is positive in general and the 6 month correction has done quite a bit of damage to individual stocks, the Claret strategy of investing in one company at a time seems to be quite appropriate.

The Claret team