First of all, with summer having just begun, we hope you have a chance to have a wonderful family holiday before autumn arrives.

We would like you to know that we are continuing to invest in our long-term plan for Claret. As part of the plan, we are moving to a new office on July 22, 2022, which will be 70% larger than our current space, to accommodate our growth, particularly the next generation, to allow us to serve you better.

Our new address will be in the Maison Manuvie building:

900 de Maisonneuve O., suite 1900

Montreal, Quebec, H3A 0A8

We have continued to invest in state-of-the-art technology, and we are now 100% in the cloud – for speed of service, to optimize our “currency” both in hardware and software, to better leverage the time of our tech specialists and the IT consultants we use, and to maximize our defence against cyber criminals and minimize our exposure to risk to the greatest extent possible. We have redundant systems to ensure we can operate even when one system may be offline for a period of time.

We continue to invest in our employees, by adding to our staff to add expertise, and with training programs to enhance the skill sets of our existing employees. Our employees are hard-working, experienced and very aware that our number 1 focus at Claret is you, our client.

Claret will continue to invest in our future to assure that we can meet your expectations and to ensure that you will continue to choose Claret – we know and respect the fact that it is your choice to do so, and that your trust has to be earned every day. Please let us know if there is anything more we can do to help you.

– Team Claret

About interest rates…

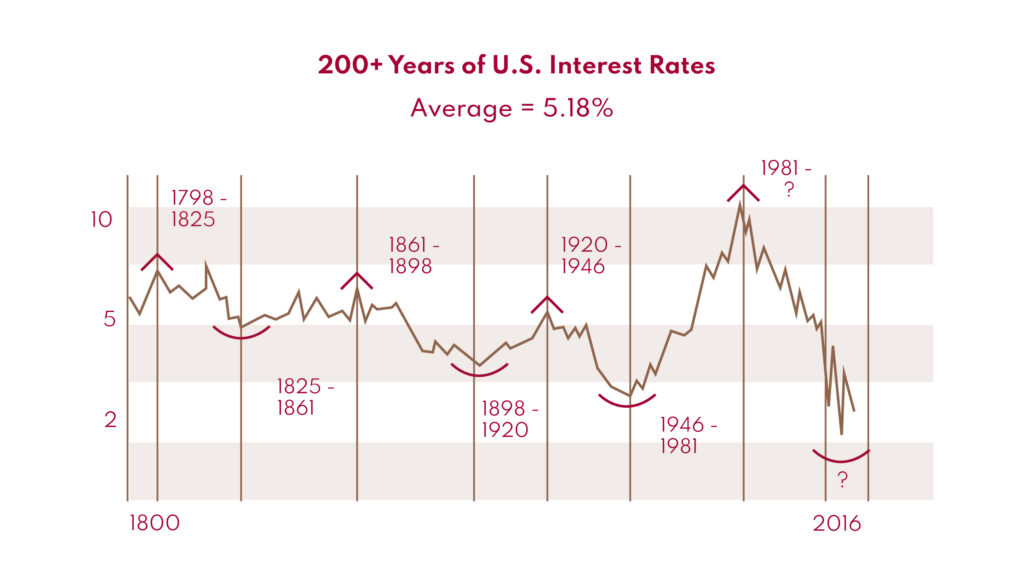

Here is a chart of the 200-year history of interest rates:

Interest rates in the 19th and 20th centuries provide illuminating trends.

After falling for three decades at the turn of the 19th century, interest rates stood at 4% in 1835. That year, President Andrew Jackson paid off the U.S. national debt for the first and only time in history, as debt was seen as a “moral failing” or “black magic” in his eyes.

After a couple of upticks over the following 2 decades driven by land speculation and a real estate bubble, rates started trending down again, starting with the end of the Civil War in 1865. Data shows that interest rates witnessed a long-term, negative slope until the end of World War I when they spiked up, driven by inflation and the Spanish Flu. They then resumed their decline all the way until the end of World War II in 1945 to below 2% – interest rates fell to 1.7% during World War II as the U.S. government injected billions into the economy to help finance the war. Around the same time, government debt ballooned to over 100% of GDP.

Fast-forward to 1981, when interest rates hit as high as 20%. Rampant inflation was the key economic issue in the 1970s and early 1980s, and Federal Reserve Chairman Paul Volcker instigated rate controls to restrain demand. It was a period of low economic growth and rising unemployment, with jobless figures as high as 10.8%.

As you can see, in the last 100 years, interest rates spend more time below 6% than above 6%. Except for the period of the 70s, when The US decided to debase their own currency, interest rates are below 4%, 75% of the time.

While the exact reasons are unclear, broad structural forces may be influencing interest rates.

One explanation suggests that higher capital accumulation could be a factor. Another suggests that modern welfare states, with their increased public spending on pensions, have as well. For instance, pension assets in the US, money that has been saved up by different levels of governments and companies for the retirement of their employees were 150% of GDP in 2019 while they were only 75% of GDP in 2005. In essence, the capital accumulated in these pensions has more than tripled in dollar terms. The trend is similar for all OECD countries. Since pension assets must be invested, and their primary asset class for investment is bonds, the resulting increase in demand for bonds has pushed up prices and thus lowered interest rates.

About Bear markets and recessions… are we there yet?

Let’s start with some observations on the state of the economy:

- The housing market has been red hot for the last year or so: many houses that were for sale received multiple bids at prices 20 to 30% higher than the asking price;

- The used car market is also red hot due to the supply chain disruption for new cars. Some dealers are offering prices for used cars that are higher than the original price;

- Restaurants operate at a much higher capacity than before COVID, even when prices are 20 to 30% higher;

- There are more cars than ever on the road, even though gas prices have gone up 35-40%;

In short, it seems that everyone has a lot of money or everyone has access to money…

I hope none of you believe that what happened in the last 2 years is to last forever. The COVID-driven money printing frenzy by all governments created an excessive demand for goods and services while the supply of such goods and services is hindered by logistics problems and a lack of workers due to COVID. Inflation is therefore the direct result of such policies. As interest rates go up, demand will dry up and a recession is not only possible but probable.

Although governments around the world always try to soften the pain brought upon by recessions through different monetary and fiscal policies, recessions are nevertheless part of the self-cleansing process of a healthy economy.

When interest rates stay low for too long, any project or start-up looks promising. Too many companies are created and tie up lots of capital, both financial and human. It is very difficult to figure out what is good and what is bad. As the cost of capital rises with the increase in interest rates, many of these “zombie” companies will run out of capital, lay off workers, restructure and/or go bankrupt. A slow down/recession will ensue, unemployment will go up and inflation will subside. And the cycle will begin anew.

Market corrections or bear markets (depending on the amplitude of the drop) are also inevitable and sometimes precede a recession. This one looks like it started between October 2021 and Jan 2022 and the decline is around 23%. When it will end is anyone’s guess.

For those who are interested in statistics (although they might not be very useful), bear markets that are associated with a recession decline 33% and last 17 months on average. Without recession, the average drop is 23% and lasts 7 months.

Are we there yet? It depends on your forecast for a potential recession or not…

The bottoming process of a bear market usually involves some sort of a credit event, i.e., the loss of a lot of money due to some aggressive decision or strategy. It also usually involves what our CEO calls the L squared condition, Leverage and Liquidity: The use of too much Leverage combined with a lack of Liquidity suddenly turns an apparently good investment into a toxic one. As of now, we have not observed any serious event yet…

The most reasonable strategy during market conditions like today is to stay put, prune your portfolio to get rid of what you no longer want and prepare to deploy cash when more pessimism prevails. Above all, stay invested: it is not timing the market that matters, it is time in the market that does.

About Claret’s strategy…

We, at Claret, continue to invest your hard-earned money in good businesses with good management. We generally focus on industries with tailwinds that produce positive free cash flow, and we try the best we can to buy them at a reasonable price.

We believe that if we happen to slightly overpay for a great company, in the long term, time will allow us to skate onside as the company continues its growth trend and we will achieve a reasonably good return. However, if we get into a lousy company at an apparent bargain price, time is running against us since we need to know when to get out in order to capture our potential gains before everyone realizes it is a lousy company.

Have a good summer 😊