Inflation is back – no doubt about that. Canada’s official inflation rate hit a 40-year high of 8.1% in early 2021, and the country continued to grapple with global supply chain issues.

And although inflation has cooled since – to 5.2% in February 2023 – food prices continue to climb.

However, the big debate isn’t just over just how high prices will rise, but whether the inflation we are currently experiencing will be temporary. What are the historical parallels to today’s inflation? How can investors shield their investments, and even take advantage of the current climate?

What is inflation?

Inflation is a permanent general increase in the price of goods and services in an economy over a period of time. When prices rise, your money can buy fewer things. What causes prices to rise is an imbalance between supply and demand. If the demand for goods and services is greater than the supply, this will theoretically lead to higher inflation. And the longer the imbalance lasts, the higher and more persistent the inflation is likely to be. No matter what you hear or read about the economic conditions necessary to see inflation, an imbalance between supply and demand remains the key element in triggering it. During the 1970s, this imbalance was created by a major supply-side shock.

Historical inflation rates in Canada

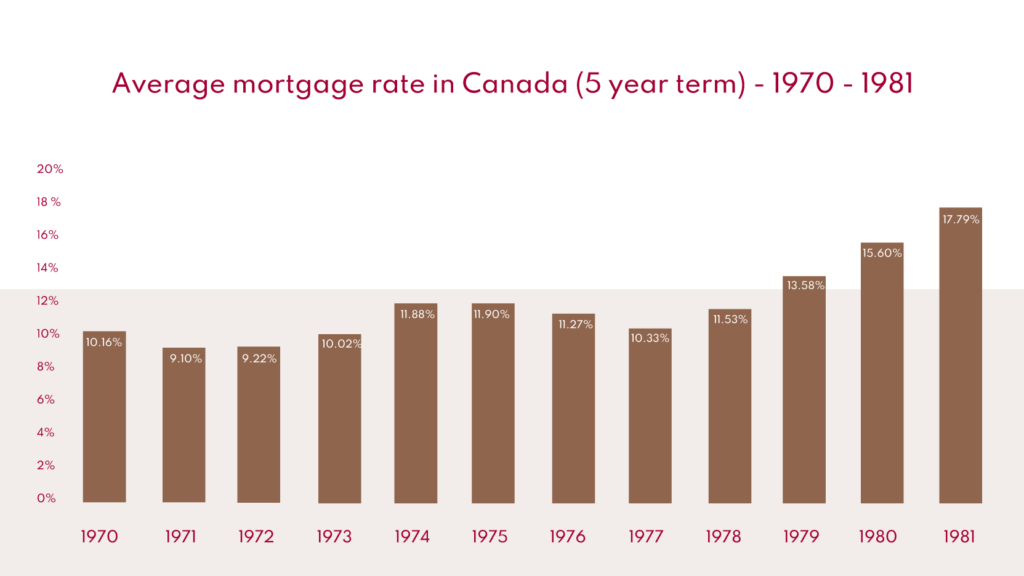

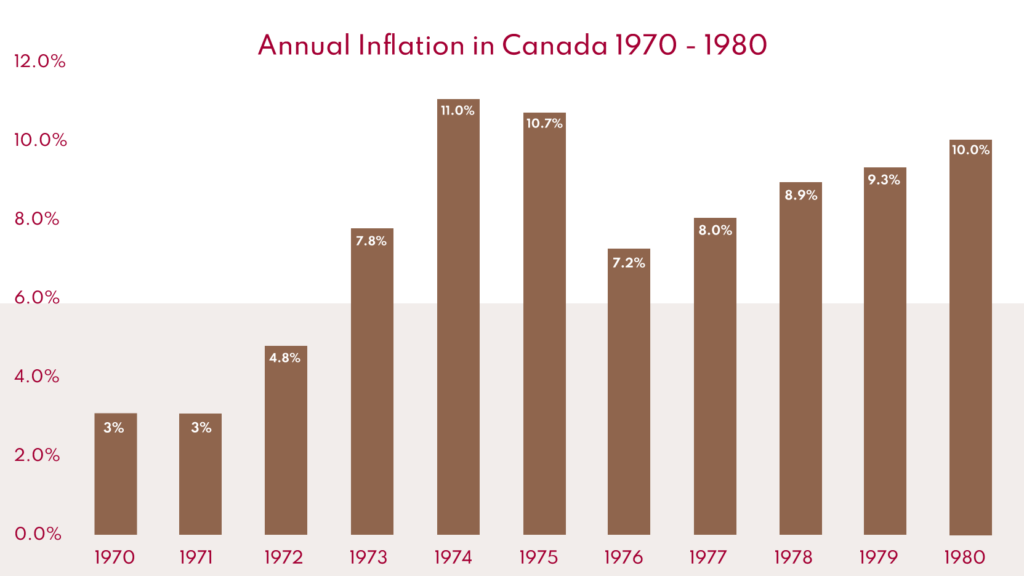

In the 1970s, annual inflation averaged over 7% and peaked at 12.5% in 1981, forcing central banks to raise interest rates significantly throughout the decade. People who lived through this era remember the 20% mortgage rates and high unemployment in various industries. It was a tough time. For younger people, it’s hard to imagine.

The 1973 oil crisis

The 1973 oil crisis began in October 1973 when members of the Organization of Petroleum Exporting Countries (OPEC) led by Saudi Arabia declared an oil embargo. The embargo, which is an official ban on trade or other commercial activities with a particular country, targeted nations that supported Israel during the Yom Kippur War. The first countries targeted were Canada, Japan, the Netherlands, the United Kingdom and the United States. People who lived through those years probably remember the lines at gas stations and the great stress of getting fuel to get through the winter. By the end of the embargo in March 1974, the price of oil had almost quadrupled, from $3 USD per barrel to nearly $12 USD per barrel.

Inflation and the price of oil

The price of oil affects inflation in an economy, as it increases the costs of transportation, materials, heating, etc. The direct relationship between oil and inflation was evident in the 1970s when the cost of oil rose from $3 USD before the oil crisis to over $30 USD by the end of the decade. This contributed to a doubling of the consumer price index (CPI), a key measure of inflation. To put this in perspective, in the past, it took 24 years for the CPI to double (1947-1971). In the 1970s, the CPI doubled in about only eight years. In Canada, the TSX index did well, with an annual return of 5.2% during those years. But with inflation averaging over 7%, most investors lost money, in real terms, which is the rate of return minus the rate of inflation.

Are we in a period of hyperinflation?

There are some similarities between the last inflationary period and today. Low interest rates and accommodative monetary policy are two common features between the 1970s and 2021. This time, the imbalance between supply and demand was created by governments around the world printing money to support their economies, stimulating or at least sustaining the level of demand. On the supply side, it was greatly disrupted by the closure of many important industries. If you shut down for months, give everyone free money, and then reopen the economy all at once, people will start spending again, and quickly. Supply is slow to adapt.

At this point, no one is saying we won’t have inflation in the near term. We’re already seeing it. Only time will tell whether this will be permanent or transitory. From energy prices to handling and transportation costs, prices could continue to rise until we get some balance between supply and demand. When it comes to slowing inflation and consumption, the central banks’ favourite tool is to raise interest rates.

How should I invest during high inflation?

There are some investments that should be avoided in a high-inflation, rising-rate environment. As Howard Marks says, “Avoid the losers and the winners will reveal themselves.”

But remember, Guaranteed Investment Certificates (GICs), low-yielding government bonds and fixed guaranteed annuities will almost certainly erode your purchasing power over time. You don’t need a PhD in advanced statistics to understand that if you buy something that pays 1% per year, over time it will make you poorer if annual inflation is greater than 2%.