Debt isn’t always a bad thing. After all, most homeowners borrow money in the form of a mortgage. Generally speaking, we want to be debt-free and pay off our mortgage as quickly as possible. However, headlines about the stock market’s recent performance raise a question: should you invest your extra savings? Or pay down your debt, like a mortgage, faster than your minimum payment alone?

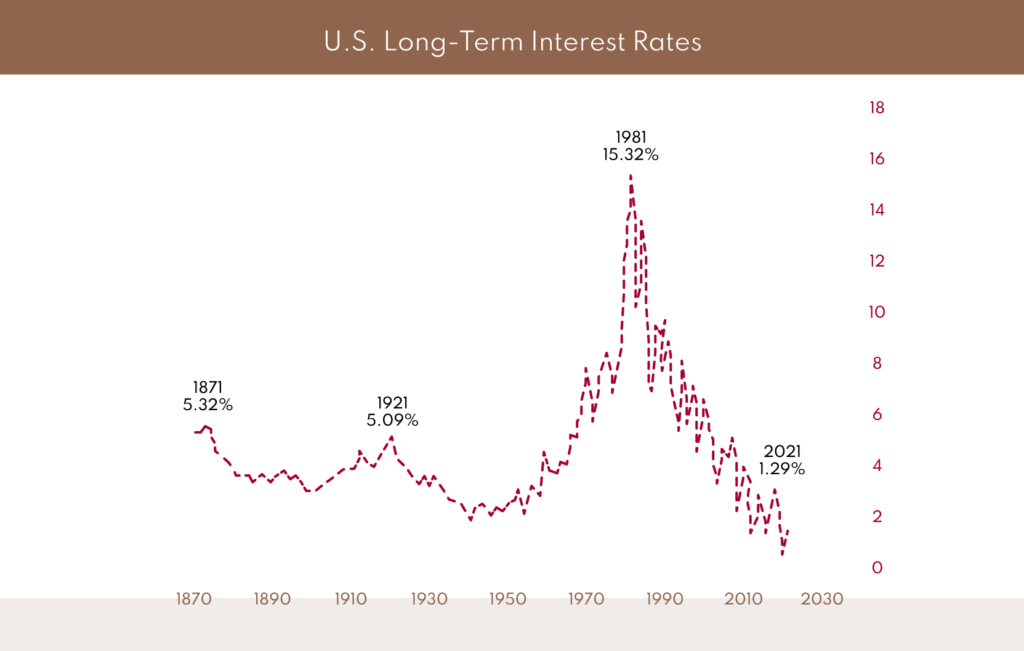

While mortgage rates have certainly increased in recent months – with today’s mortgage rates hovering around 5 to 6%, versus less than 2% a few years ago – they are nowhere near the 10% or even 15% they once were, and the stock market is looking more and more attractive. Let’s look at some of the pros and cons of investing vs. paying off your mortgage early, and see which decision best suits your needs and lifestyle.

Paying off the mortgage vs. investing: the numbers

Let’s examine this dilemma purely from a mathematical standpoint. Here’s an example. If you have an extra $500 at the end of the month, and have 20 years left to pay your $250,000 mortgage at 3% interest, should you use that $500 to pay down your mortgage, or invest it in the market?

Option one: If you use that extra $500 per month and put it towards your mortgage, you will ultimately save about $28,000 in interest having paid it back in 13 ½ years, which means 6 ½ years faster.

Option two: Invest that $500 per month over those 13 ½ years. Looking at the market’s return over the past 100 years, you could earn an average of 9% per year if you leave money invested for the long run. Therefore, if we use that 9% rate, at the end of that period, you would end up with just over $155,000.

As I mentioned in my previous article on how investment income is taxed in Canada, you would probably get taxed on your gains, but you would still come out ahead.

Why numbers don’t tell the whole story

From that example, we can easily see why investing could be a better choice than paying off your mortgage. Typically, you want to put your money where it will give you a higher expected rate of return. Since the long-term market return has been higher than the mortgage rates for a while now, investing makes more sense – that is, if we only look at the numbers.

However, the downside is the market does not always perform as expected, which means you need to be able to stomach bad periods. If you panic or if you need to get out of the market at the wrong time, you will not be able to recuperate your losses as easily. You need to be able to go through those bad periods mentally and financially, otherwise, you might have a worse outcome than expected.

The question of discipline

That brings me to my next point: numbers say one thing, but there’s human behaviour to consider as well. Putting more money on your mortgage is usually a better way to stay disciplined since it forces you to save your money in a place that is not as easily accessible. If you choose to invest instead, consider setting up automatic transfers to deposit in your investment account or you will be tempted to spend the money instead of investing it. And if the markets go up, you may be tempted to spend even more. Be honest with yourself about your self-discipline and choose an option that will work with your lifestyle.

Current mortgage rate levels

Now, let’s pause and go back to the current level of mortgage rates. As I mentioned, in Canada, you can currently get 7-year or 10-year fixed closed-rate mortgages below 6%. I cannot stress enough how low that is. You might be too young to realize how high the rates once were, but people in their 50s or 60s surely remember the 15% interest rates in the early 80s. Therefore, if you can renegotiate and lock in your rate at 3% or lower, you should do so right now. I cannot predict the future, and it is possible that rates continue to fall, but, there is a much greater chance that the rates will rise.

The final verdict

From a purely financial perspective, it is usually better to put your money where the return will be higher – the stock market – but do not forget that humans are fallible. If you are able to mentally and financially maintain the rhythm of regular investing, then you should absolutely consider this option – especially if you’re able to keep it up in the long-term. However, for some people, being comfortable with their financial situation and trying to avoid uncertainty is a better decision than running after higher returns.

Be smart about your investments and don’t hesitate to consult your advisor if you need a recommendation that is suitable for your situation.