It’s often believed that investing in emerging markets like China, Brazil, Saudi Arabia and Mexico can offer above average stock market returns. But is that really the case?

Many factors can influence stock market returns, and certainly, a growing economy creates a favourable environment for companies to prosper and increase profits. However, rapid economic growth does not automatically translate into higher stock market returns, and you should be careful not to make that assumption when investing in other countries. Here’s why.

Why Growth Doesn’t Guarantee Returns: India And China

Let’s look at China and India, two of the fastest-growing economies in the G20 over the past 10 years.

India recorded GDP growth of +5.37% per year (2012-2021) after inflation, while China posted growth of +6.68% per year over the same period. By comparison, Canada grew by +1.53% yearly and the USA by +2.12% per year.

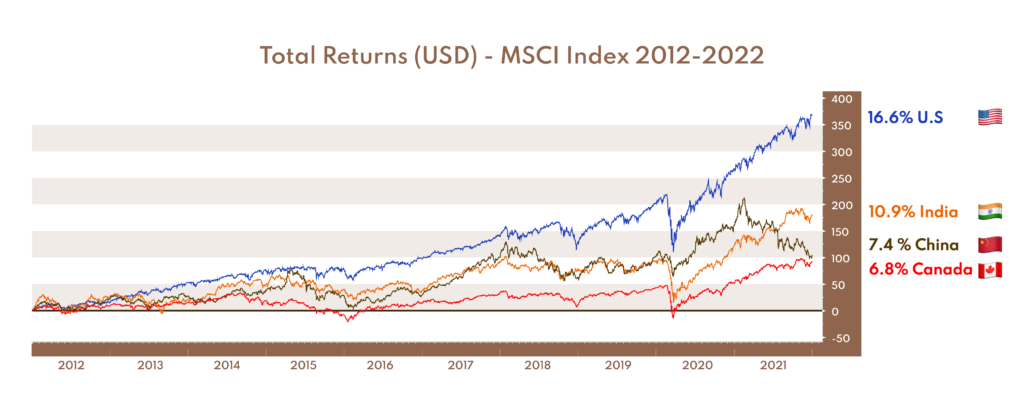

Yet stock market returns in these two countries over the same period were significantly lower than in the United States, despite their more modest economic growth. According to the MSCI index in US dollars, the graph below shows the annual returns over 10 years as follows.

This simplistic analysis is corroborated by academic research which has revealed a rather negative correlation between economic growth and stock market performance. In the 2002 book, “Triumph of the Optimists: 101 Years of Global Investment Returns”, Professors Dimson, Marsh and Staunton of the London Business School made the controversial discovery that not only is there no correlation between economic growth and stock market performance, but on the contrary, the relationship may very well be negative.

Investing in countries experiencing strong economic growth does not necessarily guarantee superior returns – indeed, it can be the opposite.

Diversification and Emerging Markets

Some argue that investing in other countries can diversify a portfolio, as global stock markets don’t always move in sync. Performance may be good in one country while mediocre in another.

Diversification can be beneficial, but it has its limits. In times of crisis, the correlation between economies tends to be stronger. When things go badly, they tend to go badly for everyone. What’s more, emerging markets are often harder hit during crises.

Investing in Emerging Markets: Risks To Consider

Although each country has its specific risks there are two main risks to consider if you’re planning on investing in emerging markets, regardless of the country you choose.

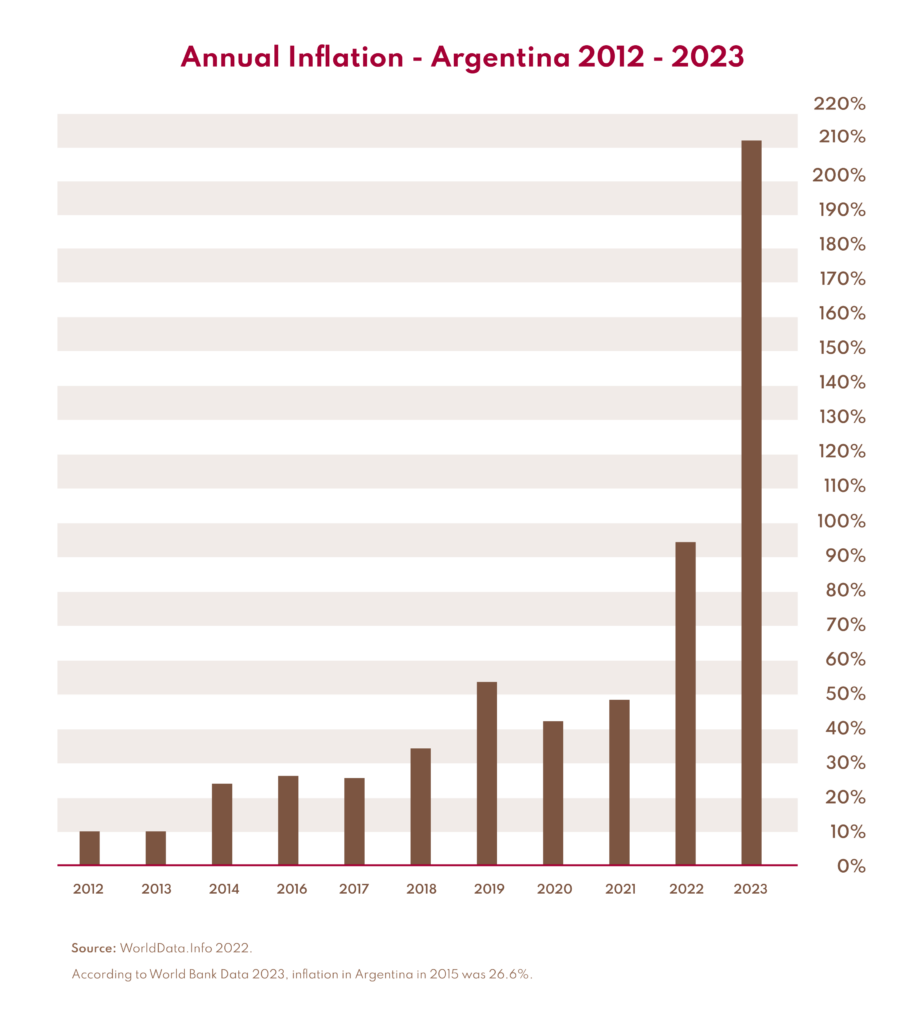

- Exchange rates and local inflation. Currency fluctuations in emerging markets are generally more severe and can have a substantial impact on returns. For example, the MSCI India index has generated a return of 11.42% per year in local currency (rupee) over the past 10 years, but only 6.71% in US dollars, due to the rupee’s depreciation of over 50% against the dollar. Moreover, there is a risk of inflation or hyperinflation, as seen in Argentina, where periods of high inflation have significantly reduced real equity returns. Particularly over the past decade, Argentina has been confronted with annual inflation rates often exceeding 20%. This inflationary instability has had a significant impact on investment returns in the country.

- Geopolitical instability: An unstable government or geopolitical event, such as war, is a major risk when investing in emerging markets. For example, the Russian stock market collapsed after the invasion of Ukraine in 2022, yet Russia was considered a rising economic power within the BRIC group, which also included Brazil, India and China.

Emerging Markets Still Have Miles to Go

It can be tempting to invest part of your portfolio in certain emerging countries, because of the potential for a home run. And it may well be worth it – but we won’t know until after the fact. Like the lottery, we know that someone will win the jackpot next week, but we can’t know who it will be in advance.

In addition to the few examples cited and the historical data demonstrating that high economic growth is not synonymous with superior stock market returns, there are significant risks involved if you decide to play this game.

Note that the stock market and the economy are not the same. The economy is the production and consumption of goods, while the stock market is a collection of shares of public companies. The economy is much larger than just the stock market. And that’s even truer in emerging markets because their stock market are nascent compared to those of developed markets.

If you can’t resist the urge to invest in emerging markets, there are a host of exchange-traded funds that can meet that need. Maybe do it with a small part of your portfolio, but I wouldn’t bet the house on it, as the risks are certainly greater than you think.