2022: a perspective on annual stock market returns in the last 100 years

Now that 2022 has ended, we can say it has been a dismal year regarding stock market returns. In fact, since the 1920s, it is the 7th worst year in terms of losses.

Moreover, the bond market also had one of its worst years in history and it is easily the worst over the last 40 years (based on the Bloomberg Aggregate Bond Market Index). The benchmark US government bond (being the 10-year US treasury bond) was down more than 15% in 2022, making it the worst year ever for bonds.

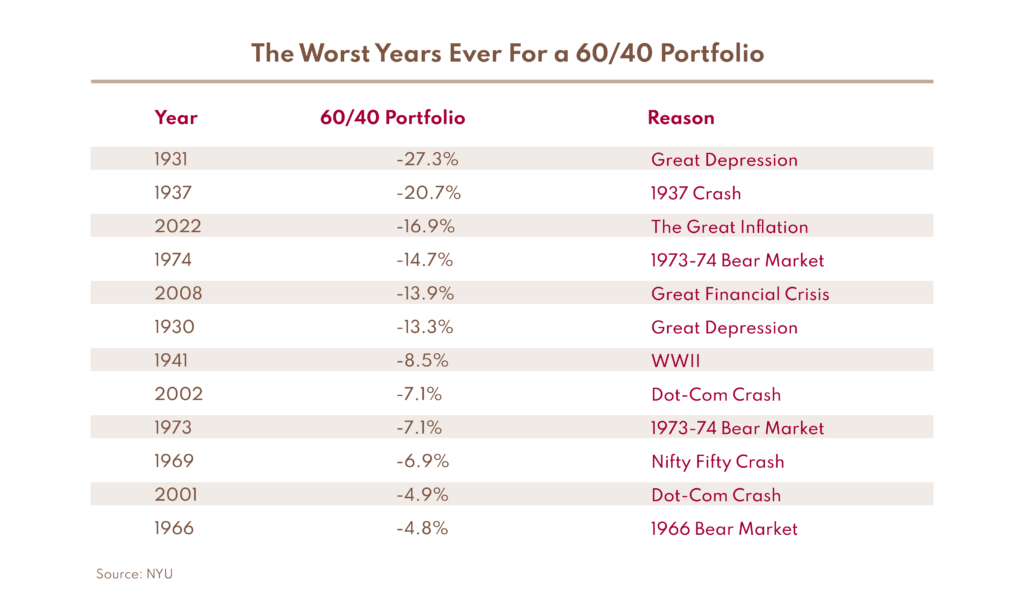

For a typical benchmark balanced portfolio of 60% equity and 40% fixed income in the US, it would be down more than 16% in 2022. It ended up being the third-worst year since the Great Depression of 1929 for a diversified portfolio:

Our performance in 2022 was negatively affected by the fact that we purposely own very few resource companies, i.e., oil and gas, mining and materials. We are also overweighted in smaller cap versus big caps companies (small caps tend to underperform big caps during bear markets).

We believe that over the long term, smaller companies grow faster than mature multinationals and companies tend to operate better in stable environments than in highly cyclical ones. It is therefore more beneficial to investors that portfolios be less weighted in cyclical industries and more heavily weighted in smaller capitalization companies. There is a multitude of research confirming our views and we will be glad to share them with you either through emails or in-person discussions.

Are we there yet? … A little more on financial history through statistics.

As we look forward to 2023 and beyond, investors wonder how long the beatings may continue and how far down the road they may have to go to see recovery. We obviously don’t have a clue. However, we did write this in our Q2 quarterly letter:

“Market corrections or bear markets (depending on the amplitude of the drop) are also inevitable and sometimes precede a recession. This one looks like it started between October 2021 and Jan 2022 and the decline is around 23%. When it will end is anyone’s guess.

For those who are interested in statistics (although they might not be very useful), bear markets that are associated with a recession decline 33% and last 17 months on average. Without recession, the average drop is 23% and lasts 7 months.

Are we there yet? It depends on your forecast for a potential recession or not…”

So, a question you could ask yourself is: are we going into a recession? If not, the correction/bear market is pretty much over (a drop of 27% in 10 months) and the recovery may have already started. On the other hand, if a recession is coming (it seems like every economist thinks so), we could see some rough seas in the next 6 months …

BUT does it really matter?

When investing in the stock market, we should plan on staying invested for at least five to 10 years (or more). Finding properly valued companies that will make it through a recession is much more important than whether we still have a few months of stock market fluctuations left. Most great fortunes are made with a buy/build and hold strategy, from Rockefeller to Warren Buffett, Bill Gates and Jeff Bezos. As we wrote in our Q2 quarterly letter: “Above all, stay invested: it is not timing the market that matters, it is time in the market that does”.

Short-term events are what drive selling newspapers, and CNBC and Bloomberg news ratings: how bad will inflation get? How high will the Fed raise interest rates? Will those cause a recession? How bad will it get? All those concerns, albeit legitimate, deal with the short term, the next year or two. This mindset is more suitable for people with a trading mentality. It reminds us of an old joke from a legendary investor:

“Two friends meet in the street, and Joe asks Sam what’s new. “Oh,” he replies, “I just got a case of great sardines.”

Joe:

Great, I love sardines. I’ll take some. How much are they?

Sam:

$10,000 a tin.

Joe:

What! How can a tin of sardines cost $10,000?

Sam:

These are the greatest sardines in the world. Each one is a pedigreed purebred, with papers. They were caught by net, not hook; deboned by hand; and packed in the finest extra-virgin olive oil. And the label was painted by a well-known artist. They’re a bargain at $10,000.

Joe:

But who would ever eat $10,000 sardines?

Sam:

Oh, these aren’t eating sardines; they’re trading sardines.”

We believe that most people treat stocks and bonds like something to trade, not something to own. At Claret, we approach investing with a long-term mindset and view stocks and bonds as assets to own, rather than just trading instruments.

Our research process

As we have just finished another year of interesting stock market moves, we think it is a good time to review our approach to investing. We would like to start by stating that it should always be remembered that the stock market is, in fact, a market of stocks – all different companies that are independent for the most part and are in different industries, sectors, regions, markets and regulatory environments. They are run by different managements, led by different boards of directors with a different complement employees. Most have a different cost of capital and different corporate strategies.

They are very much affected, but differently, by economic factors like the comeback of inflation, higher interest rates and exogenous factors like the Russian invasion of Ukraine and the Covid-19 pandemic.

As difficult as it is to measure these variables and predict their outcome and likely interactions, the most difficult of all factors to gauge is investor sentiment.

How do we do to try and find the diamonds in the rough?

In Finance, fundamental research is broadly defined as a process of looking for investment vehicles that have a decent probability of providing a reasonable return over time, relative to the risk involved. The more insightful the research, the higher the probability of success.

The qualitative side of our research process consists of finding companies that:

- Have good management,

- Possess a relatively strong competitive position,

- Operate in industries with tailwinds,

- Have some control over the pricing of the products/services,

- Appear to benefit by “TINA”: There Is No Alternative.

The quantitative side of our research consists of:

- Making sure the companies are profitable, meaning they generate positive free cash flow (after maintenance reinvestment),

- Analyzing financial statements to evaluate the strength of the companies in case of difficult economic environments and their earnings power in good economic environments,

- Trying not to overpay for the future profits of these companies.

To complement our own in-house research, we review a wide variety of public and private research that is available. We also interview company management including CEOs and CFOs (although information gathered from the smaller companies is much more valuable than what can be gathered from the big ones) and read earnings reports and management comments. We also try to talk to competitors and peers to try to acquire as much insight as possible.

We favour management teams that are consistent, transparent and shareholder friendly. For smaller caps, we favour management teams who are significant shareholders, directly through equity ownership rather than stock options.

Among the characteristics that we try to avoid, let us mention the following:

- Self-promoting narcissistic management,

- Outsized compensation packages,

- Too many stock options.

In summary, the fundamental research process encompasses many ways to gain better insights regarding a company’s business, industry, and long-term strategy. The financial analysis only makes sense when we have decided that qualitatively this is something we understand, and we would like to own, and if it is cheap enough relative to future potential earnings.

Alternatively, over the years, through our research, Claret has developed a strategy that is fundamentally driven but with a quantitative approach that has resulted in very good returns over the long term. It is currently being deployed in our Pooled Funds, specifically in Claret Canadian Equity, Claret US Large Cap Equity and Claret European Equity. It is solely based on investing in profitable companies, profitability being defined as having positive free cash flow, choosing select industries, and continuing to avoid cyclicals such as resources. Our backtest using these selection criteria has generally given us an advantage of 2% or more annually over the benchmark on a long-term basis.

We wish you and those you love a warm, healthy, happy and prosperous 2023.

-Alain Chung, Chief Investment Officer, on behalf of the Claret Team