2024 turned out to be a very good year for equities in North America: the US market (the S&P 500) is up 25% and the Canadian market is up 21.6%. Meanwhile, the MSCI Europe is up a paltry 8.6% and the MSCI United Kingdom is not much better, up 9.6%.

While it is all good news for the stock markets, it is not so for the bond market. Yields have crept up slowly over the last 2 years and the average return on bonds is in low single digit. The returns on longer-term bonds are in the negative zone – e.g. the 20YR + US Treasury Bond had a total return of -2.8% per year from December 31st 2022 to December 31st 2024.

We stand by what we wrote last quarter: as the yield curve normalizes, we should see short term rates come down somewhat while long term rates go up somewhat. In other words, spreads will widen.

Bubble watch…

Whenever markets are as hot as they are right now, investors always ask whether we are in a “bubble”. The bear market camp would point out how inflated stock valuations are in terms of price/earnings ratios, the endlessly growing US deficit, the seemingly out-of-control growth of the US national debt and the unaffordable social spending programs. The bull market camp would emphasize the profound technological change, the scientific progress made in medicine and other fields and the soaring corporate profits.

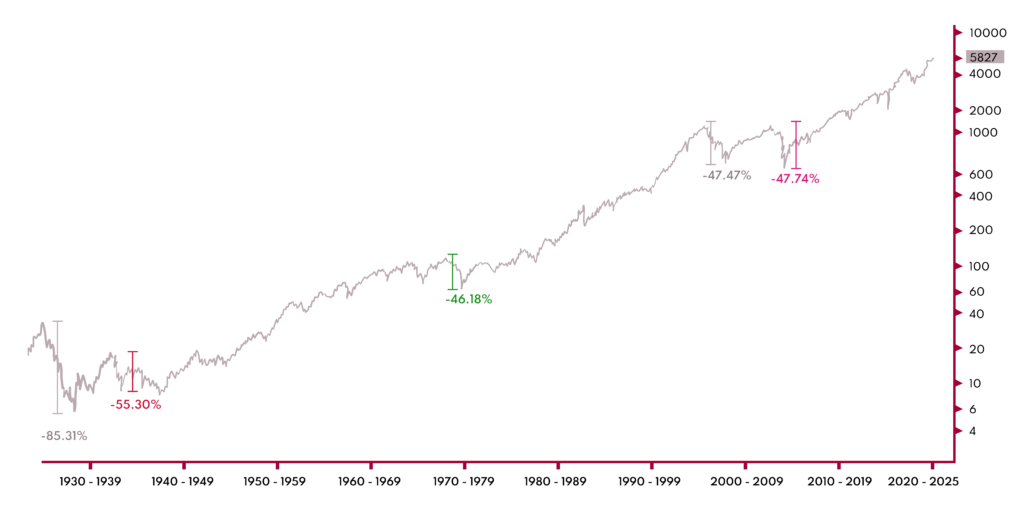

Since Mark Twain purportedly said, “history doesn’t repeat itself, but it often rhymes”, let’s go back to history for some insight (all prices are based on the S&P 500):

This is the historical price of the S&P 500 since 1927: (courtesy of Bloomberg)

- First, let’s try to define a “bubble”: quantitatively, a stock market “bubble” should reflect a rapid rise in prices (the mania phase), which could last months, even years, followed by a long, sometimes sharp decline in those same prices which could also last months, even years. From top to bottom, corrections can amount to 50% or more.

Defined as such, since 1927 (97 years of data), there are 5 significant stock market “bubbles” that we can observe: 1929, 1937, 1973, 2000 and 2007.

Equally important is the psychological side of bubbles. They usually are characterized by investors feeling exuberant, adoration of certain assets (the Nifty-Fifty stocks, anything followed by “Dot com” …), pervasive FOMO feeling (Fear Of Missing Out) and conviction that there is “no price too high”.

- Whereas the word “mania” emphasizes the irrationality, “bubble” foreshadows the bursting. The aftermath of a bubble bursting is quite painful: it usually takes several years for the market to recover back to the last peak. After 1929, including reinvesting dividends, it took the market 20 years to recover; after 1937, 7 years; after 1973, 5 years; after 2000, 6.5 years and after 2007, 5 years. However, we can lump the 2000 bear market with 2007 as one big bear that took 11 years to recover.

- While it is obvious that if an investor gets caught in the bursting of a bubble, the pain is real and debilitating. However, over the long term, we know time heals most wounds. In fact, even for an investor with extreme bad luck/bad timing who got in at the peak of a bubble, the annualized returns from each peak 20 years later are as follows:

- 1929-1949: 0.45%

- 1973-1993: 11.1%

- 2000-2020: 4.66%

- 2007-2024: 10.19% (17 years…)

As you can see, except for the Great Depression bear market of 1929, the annualized return over the next 20 years fluctuated between 5 to 10% per year. A disciplined and patient investor who keeps a steady investment program (like a dollar averaging strategy) over the long term would have ended up with a much higher return than 5 to 10% per year.

Predictive power of dividends for future returns: myth or reality?

Literature abounds with information regarding the predictive power of dividends for future returns. There are models and funds that are built on the belief that if investors buy the highest dividend yielding stocks, they will end up with a higher-than-average return over time.

The appeal is obvious: during the long period of near zero interest rates that began in 2008, investors were scrambling to get a higher income than bonds through dividend paying stocks.

Unfortunately, the reality is a little more complex:

- Dividends are a return of your own money since you ARE the shareholder (fractional owner). It is ludicrous to believe that if you pay yourself more money out of your company, the latter would be worth more intrinsically, which is what these financial models imply.

- Just imagine you own 100% of the company. Would you think that it will be worth more after you pay yourself 1,000,000 dollars of dividends??? I think not.

- A company that pays a steady stream of growing dividends needs to be financially robust and growing. If not, it is actually emptying its coffers and destroying its future.

- Some companies go even further: management would borrow money to pay dividends to their shareholders, as a sign of confidence for the future of the company. They should be fired for incompetence instead.

Dividends are one of many factors we use in our analysis process, and it is certainly not the most important one. High yielding stocks often come with higher risk and more volatility. It is more of a red flag than a green flag when yield on a common stock is too high relative to the overall market.

Are Private companies/Private Equity good for you?

Investment in private companies and/or private equity has long been only available to accredited investors and venture capitalists. It is now accessible to the masses through new products and funds. Promotions abound on the benefits of this asset class, ranging from potential high returns, to diversification, to access to high growth.

We are quite leery about this asset class:

- Most promotions are based on the FOMO (Fear Of Missing Out) factor most investors suffer from. Why would anybody want to invest in an asset class where information is sparse, management fees are high and liquidity is low if not non-existent.

- The manager of one of these funds actually said, and I quote: “we offer daily liquidity to an illiquid asset that is typically reserved for institutional investors.” Pretending you can turn an inherently illiquid asset into a liquid asset is a fallacy that borders on fraudulent investment advice.

- We analyze public companies with all the information available and God knows it is already difficult enough to get it right, what do you think we can achieve when there is almost no accessible information in private companies except for the price you pay? Buffett said a long time ago: “price is what you pay, value is what you get”.

Focusing on public securities in a regulated environment is a much better use of our time.

Interesting anecdotes

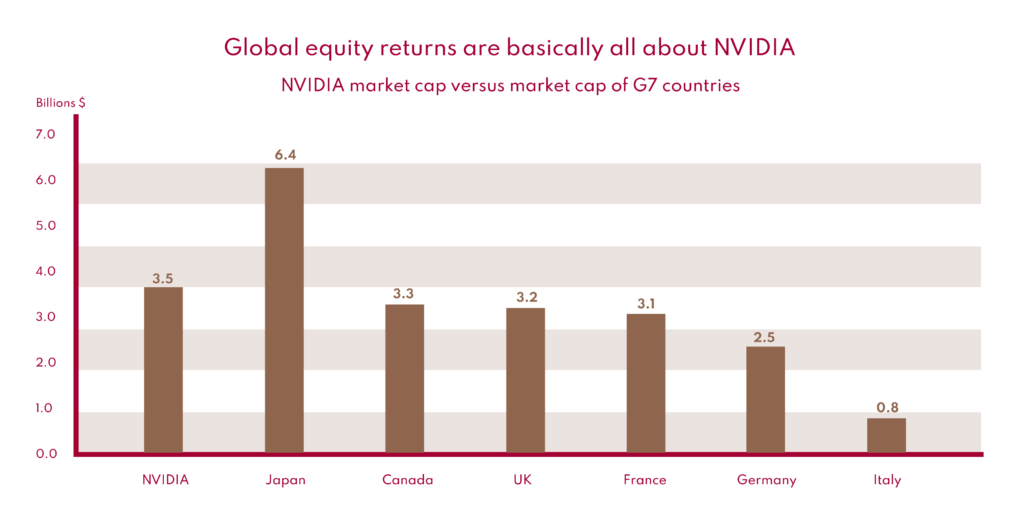

- Did you know that Nvidia’s market capitalization is greater than the total market cap of five of the G7 countries? Only Japan and the US are bigger…

Source: Bloomberg, Apollo Chief Economist

- Do you know the definition of “diplomacy”? It is the art of saying “nice doggie” until you find a stick…

- Monique, our CEO, pointed out to me how quickly the word “UNCLEAR”, with a typo of inverting the first 2 letters, can become “NUCLEAR”, as in UNCLEAR political hyperbole….

- In the same vein, if you spell Nvidia as “INVIDIA”, it means envy in Italian…

- Charlie Munger has said: “The world is not driven by greed. It’s driven by envy”. He warned that envy is a ‘Stupid Sin’ that brings only Pain and no fun — ‘someone will always be getting richer faster than you’.

- So, Nvidia was up more than 180% in 2024 this year, and you don’t own it???

A bit of history and perspectives…

- As much as the Republicans want to take all credit for free market policies, it was President Carter, a democrat, who started the deregulation of the energy industry in the ‘70s. He also deregulated the airlines industry in 1978 and nominated Paul Volcker as Fed chairman who fought off runaway inflation in the late ‘70s and early ‘80s.

Moreover, it was President Nixon, a Republican, who put in price controls on gasoline to combat inflation. Instead of solving the problem, it created a shortage of gasoline and lineups of 5+hours for Americans to fill up their cars.

The moral of the story is: ignore the politicians’ affiliation, study the policies.

Lining up for gas in the 70s.

- Catastrophic events (related to the environment or not) are generally positive for insurance companies. The former allows the latter to raise prices on their insurance coverage, therefore making it more profitable for their shareholders. In fact, benign weather activities encourage competition between insurance companies.

The premium will eventually decline to a point where there will not be enough money to cover the catastrophes that will inevitably return.

Maui devastation in 2023

Like the old song by Manfred Mann’s Earth Band… don’t be, “Blinded by the Light”. All the political hyperbole and exaggeration taking place locally and around the world should be taken as posturing and political jousting – All the promises and threats will likely morph into something quite different in the fullness of time. The market usually sees through all of it. And when faced with a provocateur or bully, sometimes steely silence is the best response as you wait for an opportunity to have an advantage… you don’t have to attend every argument you are invited to.

With that, we wish you and your family the happiest and healthiest of years in 2025.