As the day winds down on March 31, 2022, we find ourselves living in interesting times.

Government spending and budget deficits, fuelled by historically low interest rates and a global pandemic, are out of control across most developed nations. Money has been “free” for a couple of years driving demand and consumption and increasing the prices for hard goods, housing and commodities. As Governments decided to distribute money directly to the consumers and encouraged them to spend in the last 2 years, the pandemic-driven supply constraints have also restricted the availability of all goods and services. No wonder inflation is galloping to levels not seen since the 80s.

The world is now taking sides in a 5-week-old war between Russia, the unprovoked aggressor, and Ukraine. Virtually everyone is supporting the underdog – Ukraine – after Vladimir Putin has once again lied about his hegemonic intentions and invaded their outmatched neighbour. However, Russia’s military strength, which everyone including Putin seems to have overestimated, has so far proven to be no match against the guile and courage of the proud and determined Ukrainians and their heroic leadership on the “battlefield”, all being led by Volodymyr Zelensky. They are fighting for the right to live freely and peacefully in their own sovereign country. They lead by example when positive and uplifting images are in short supply.

This and other headlines might cause an individual to pause and believe that the world is in fact on the edge of a precipice. The reality is that markets “climb a wall of worry” and the S&P 500, the 500 largest public companies in the US, is down only 5.97% since its all-time high in 2021. The Dow Jones Industrial Average (30 companies) is 6.15% below its all-time high of last year and the S&P TSX which is Canada’s major index is only 1.37% below its all-time high which was recorded on March 29, 2022 – largely due to the performance of the commodities (i.e., mines, steel, oil and gas) sectors which have reflected the sanctions placed on Russia and the global trade impacts on the energy resources.

Employment levels are at all-time highs, and staffing is difficult for many businesses– economies are at full employment and wages are rising. In short, things are not all bad.

People and countries around the world are coming to the aid of Ukraine. They want to see the “right thing” done within Ukraine’s borders, and they want to see the millions of refugees find a safe place until they can return to their homeland.

Europe may finally become a real “Union” of like-minded cooperative countries.

People are turning toward electrifying transportation, exchanging their internal combustion engine vehicles for electric vehicles and embracing the concept of ESG (Environment, social and governance) for a better future.

Globally everyone is hoping for a brighter future – for their children, for others and for themselves.

Almost everyone shuns violence, lawlessness and unfairness – even if it doesn’t make the headlines.

Some look forward to “paradise” in the hereafter but most of us want our peaceful bit of “paradise” in the here and now.

The question we often ask ourselves is: Can I/we afford our bit of paradise for the remainder of our lives? And how do we know if what we have will be enough?

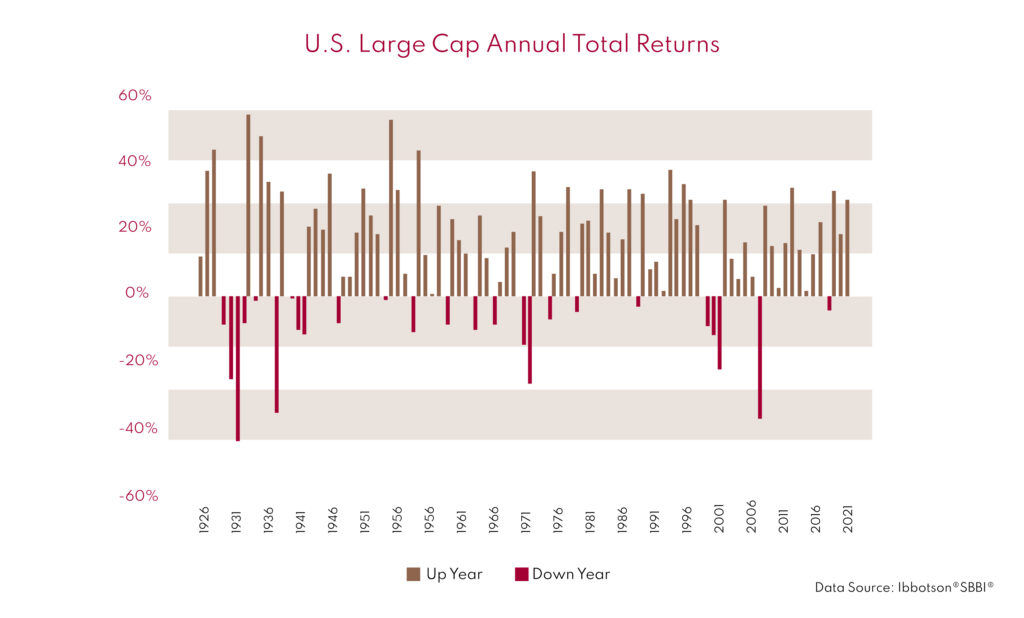

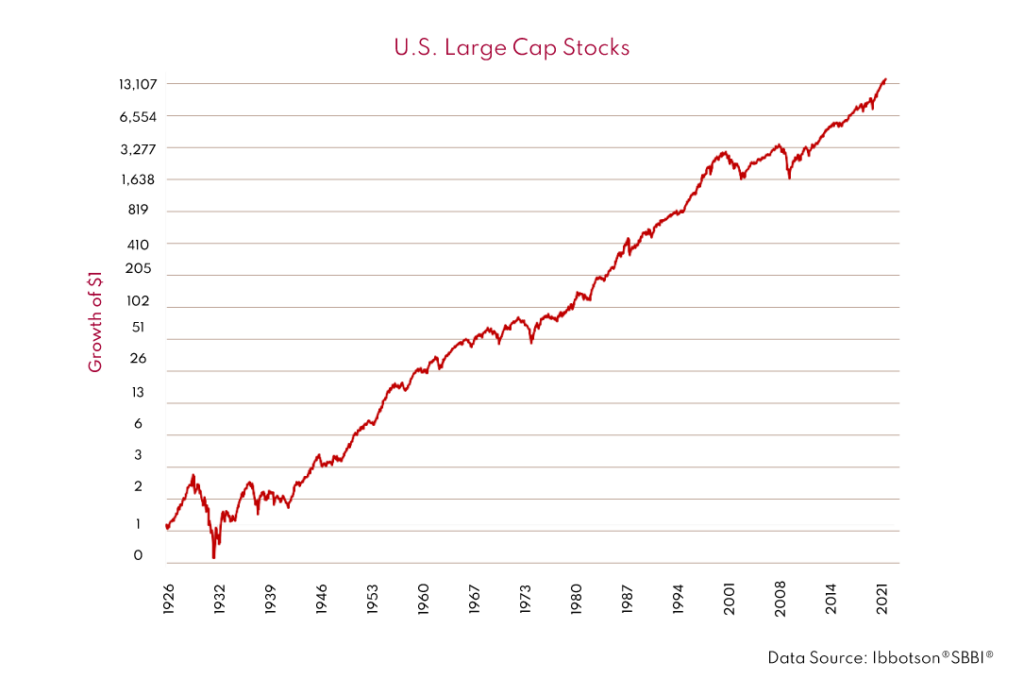

Financial planning is important to keep in mind as you make key decisions throughout your life. All of your fiduciaries should understand your situation and be aligned in the process to help you achieve your goals. Many people do not grasp the fact that to plan means you need to prepare but that it is not a guarantee your predictions will be exact. One of the shortcomings of financial planning is that you use an arbitrary rate of return and project into the future. Not only are you predicting the future, but you also assume the world economy will grow at a steady rate with no incidents or unexpected events along the way. We have never seen a plan that includes an occasional negative return in the future. The following chart illustrates the last almost 100-year annual returns of the S&P 500. How realistic could it be if a financial plan is based on a single and specific annual rate of return? It is always important that your portfolio manager is aware of any changes to your financial plan like cash requirements or your changing needs to help adjust your plan for the future.

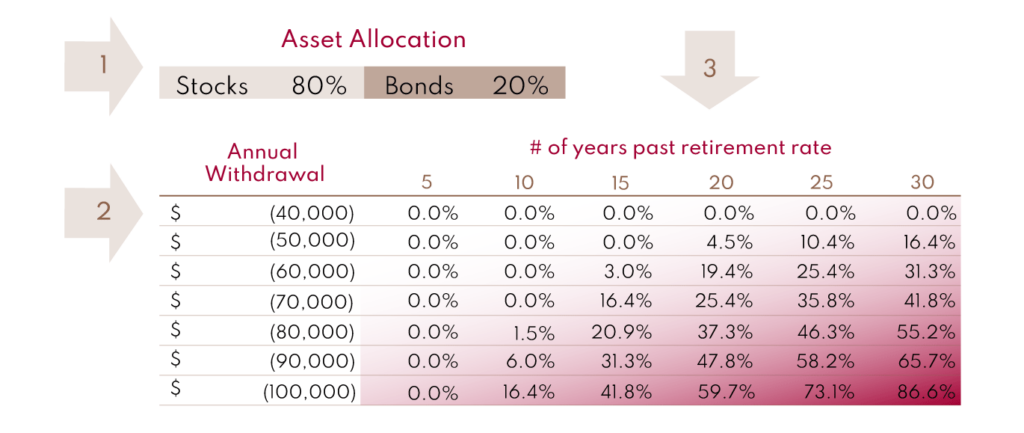

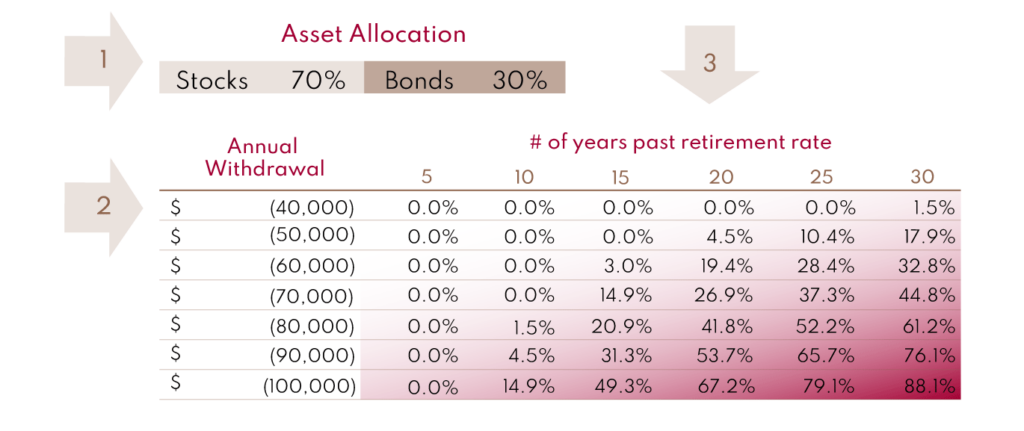

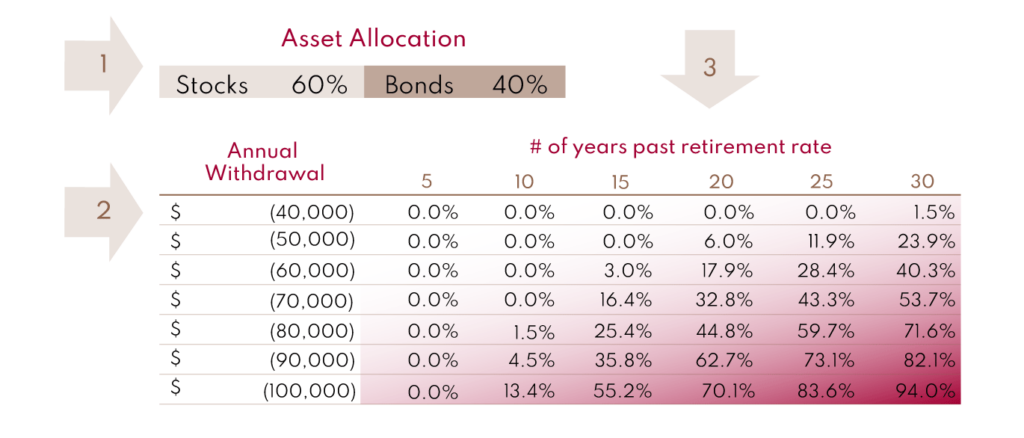

We decided to take a different approach to answer the question: using the last almost 100 years of historical market returns on stocks and bonds, we will simulate a multitude of 30-year periods, observe the results and derive a probability of running out of money based on a certain amount of annual spending. Not only are the empirical results realistic, but we also believe it is more appropriate to express in terms of probability regarding future events. As an example, let’s take a 65-year-old investor with $1,000,000 of initial capital and a total spending of $40,000 a year indexed to inflation (total means everything, including taxes that must be paid). What is the probability of this investor running out of money when s/he will be 80, 85, 90, etc.?

The table below would give you a vaguely right answer to that question. From there, it will be easy to prepare without predicting.

The answer for the case above would be:

1/. Let’s say the asset allocation is 80% equity and 20% fixed income;

2/. Find the line where $40,000 is printed;

3/. Since the investor is 65 years old, 85 would be 20 years past retirement.

The answer is 0%, i.e., s/he will not run out of money. 😊

The table is designed with $1,000,000 of initial capital. It is scalable to whatever initial capital you need it to be: for $3,000,000 of initial capital, just multiply the first column by 3, i.e. ($40,000 will become $120,000).

Just as a side note, as you can see on the table if you have $1,000,000 and decide to spend $100,000 per year, may luck be with you because we can only do so much…

One last thought for this quarter regarding market timing and taking profits: we often hear from clients, accountants and other market pundits that “a bird in the hand is worth two in the bush”. This is probably the most misused quote in long-term investing. It goes against the basic principle of compounding, which is to delay consumption to let capital grow exponentially. Look at the chart below:

This is how the S&P 500 has fluctuated since 1927, excluding dividends: a long-term uptrend. We would conclude that we would rather wait for the 2 or plus birds in the bush….