Stock splits are all the rage lately. Google parent company Alphabet, Amazon, Tesla, and Shopify are among the latest companies to announce a stock split, and each of them was rewarded with a post-announcement boost.

But what, exactly, is a stock split? And why are companies all of a sudden obsessed with splitting their shares? Here’s what you need to know about stock splits.

What are Stock Splits?

A stock split allows a company to break each existing share into multiple new shares, in theory without affecting its market value, or each investor’s stake in the company.

For example, a company might take one share of a stock and split it into two shares. The total combined value of the two new shares still equals the same price of the previous single share.

Let’s say Company XYZ completed a 2-for-1 stock split. The original share price was $20 for one share.

The new two shares are each priced at $10. An investor who held fifty, twenty-dollar shares pre-split, would now own 100 shares at the new price of $10 each.

Although the number of shares outstanding increases by a specific multiple, the share price should drop in proportion to that multiple, because the split does not make the company more valuable.

Technically, there is no fundamental impact from a stock split beyond an increased share count. However, correlation is not causation, and there are plenty of reasons to pay close attention to a company that announces split plans.

Why Do Companies Split Their Stocks?

A stock split is often a sign that a company is thriving and that its stock price has increased. While that’s a good thing, it also means the stock has become less affordable for investors. As a result, companies may do a stock split to make the stock more affordable and enticing.

As a company’s stock price increases, investors are rewarded with higher returns. Eventually, the stock may reach a price that makes it difficult for new investors to jump in and purchase shares. This is where the stock split comes in.

Companies that do splits tend to do so because their stocks have risen a lot – and stocks with positive momentum often tend to keep rising.

Do Stock Splits Improve Returns?

Although the number of shares outstanding increases by a specific multiple, the share price should drop in proportion to that multiple, because the split does not make the company more valuable – or so the theory goes. In reality, it’s a bit more complicated.

In a September 2011 paper titled, The Information Content of Stock Splits, three esteemed professors determined that “stock splits contain more information about future, rather than past operating performance.”

If that’s true, stock splits could very well be a secret weapon for finding a successful company. If we look at S&P 500 companies that announced stock splits between 2012 and 2018, the results are staggering. Just announcing a stock split gave an average immediate price boost of 2.5% to a stock. One year later, these stocks outperformed by an average of 5%.

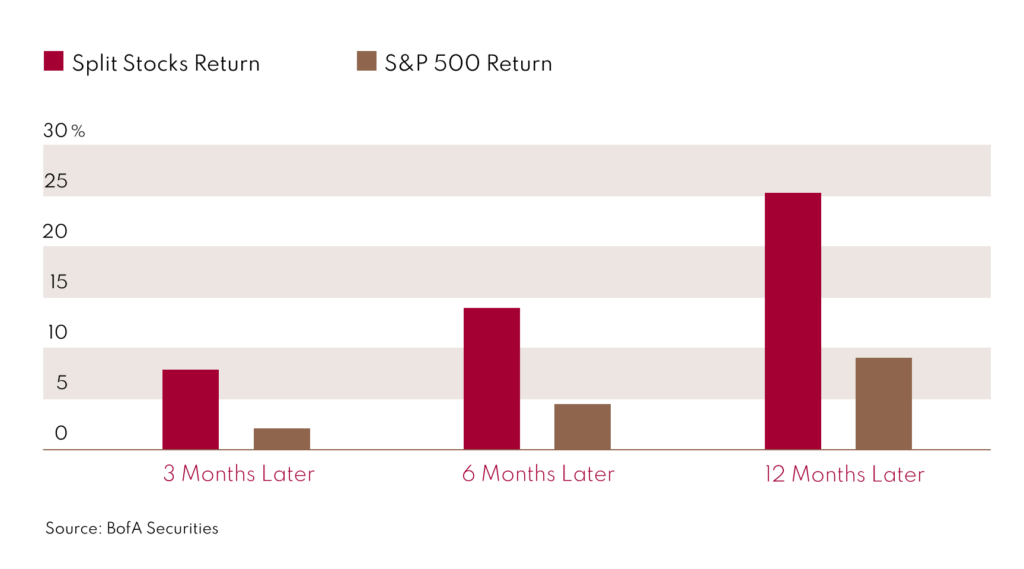

Indeed, if we look at the table below, we can see that since 1980, S&P 500 stocks that announced stock splits have beaten the index by 16 percentage points on average the following year.

However, today’s market swings, caused in part by volatile earnings from previously high flying tech companies and new expectations for the Federal Reserve’s wind-down of their balance sheet and rising interest rates, have led to a market decline. Many of the companies who have announced a split have seen their stock price returns dwindle since the announcements.

How Does a Stock Split Affect My Investments?

As a shareholder, you may worry that a stock split will affect your investment. Ultimately, there’s little impact on you as an investor. Investors will technically own more shares, but each share will represent a correspondingly smaller percentage of ownership in the company.

“…stock splits contain more information about future, rather than past operating performance.”

The Information Content of Stock Splits.

Low share prices make it easier for retail investors to buy a small number of shares. Splits also had the effect of reducing stock trading commissions for smaller investors. However, the rise of commission-free trading platforms and fractional shares have made it easy for small investors to put as much cash as they want behind their favourite stocks.

Google (whose stock is known today as Alphabet), meanwhile, split its stock only once, in 2014, giving shareholders a new, non-voting share for every share they already owned. The split cemented the long-term control of the company’s founders — a controversial action that Facebook (known today as Meta) tried to repeat with a new class of non-voting shares of its own, before dropping the idea after protests from shareholders.

If you’ve been considering investing in a particular company, a stock split signals that it’s doing well. Because the per-share price is lower, stock prices are also more affordable, which means investors can potentially buy more shares.

Stock splits can certainly excite investors, but remember – they don’t directly affect the value of an underlying business. If you’re investing in a company after a stock split, approach it with the same level of analysis and curiosity that you would for any other company. It’s important to always do your research before investing. While a stock split can be a good sign, other metrics like revenue growth and market opportunity are much more important.