Even using the most optimistic growth assumptions, stock valuations in this industry are truly high (pun intended). At this point, significant losses can be expected…

As you know, in addition to performing its own research, Claret also uses the services of independent research firms. This way, our clients benefit from unbiased analyses, the sole purpose of which is to help generate good returns.

A recent analysis by Veritas, one of our providers, shows that investors in the cannabis industry will have to wait several decades before even beginning to achieve a return on their investment.

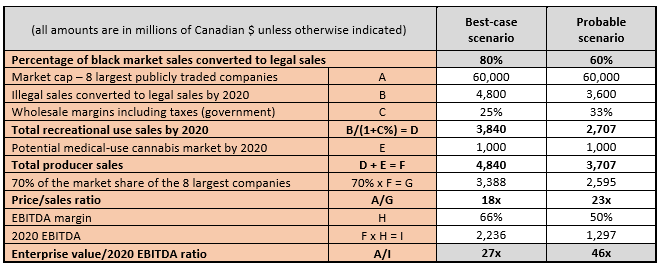

According to Statistics Canada, the total market for cannabis products intended for recreational use is estimated at $6 billion, including the black market. Considering that between 60% and 80% of the market is expected to be captured by “legal” retailers following legalization, the recreational use market would be somewhere between $3.6 and $4.8 billion. It should be noted that only Colorado and Nevada have experienced such a significant shift from illicit to legal sales; figures for other U.S. states that recently made marijuana legal are considerably lower.

Taking into account the share of various government levels (the SQDC in Québec, for instance), the medicinal use market, estimated production costs, and retail prices, Veritas believes that producers’ EBITDA could range between 50% and 66% by 2020.

As well, the price war between the black and legal markets in the U.S. in the years following legalization put a strong downward pressure on prices, shrinking margins for all industry players.

Thus, based on the market capitalization, i.e. $60 billion, of the eight largest publicly traded cannabis producers, who make up 70% of the market, the analysis shows that investors are currently paying between 27 and 46 times the 2020 EBITDA! Valuations that bring to mind the exuberance of the dot-com bubble.

Details of Veritas’s calculations:

As mentioned in our latest quarterly letter, we believe that, as with the bitcoin story, this one too will likely end badly for most investors/speculators. We’ll take a pass.

The Claret Team