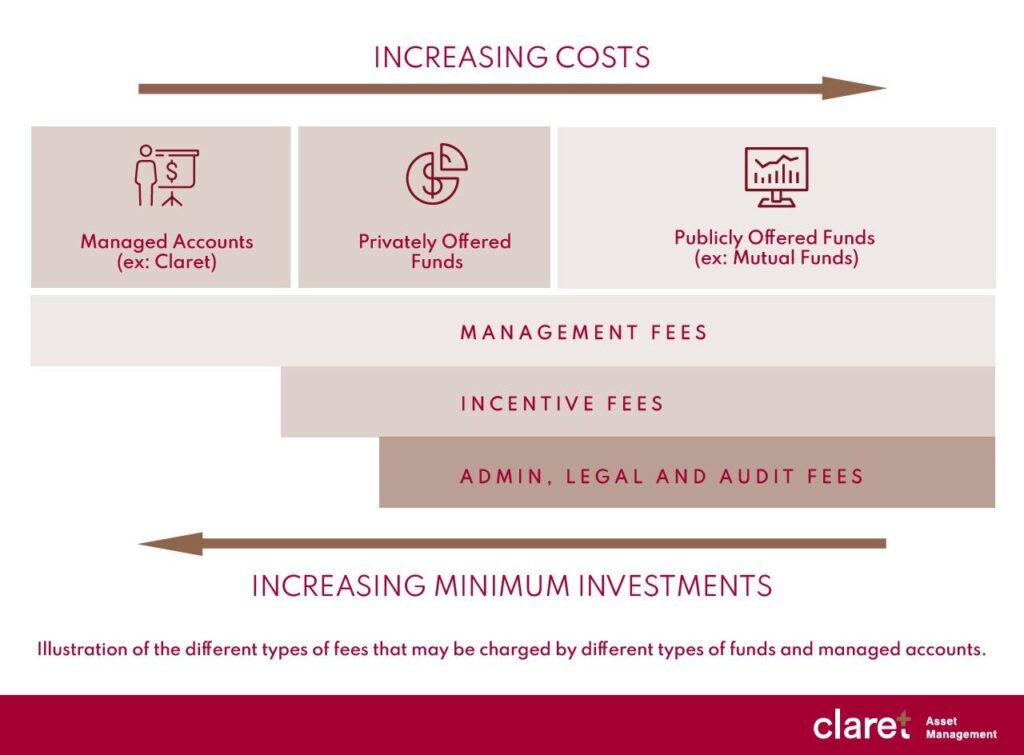

It can be hard to get a handle on the true costs of investing. In addition to management fees, there are often other costs and fee structures that can surprise you, depending on where, and how, you invest.

But while fees come in all shapes and sizes, you should always know what you’re paying upfront. Here, we break down some common investing fees and explain some common misconceptions associated with mutual fund fees, management fees, and hidden costs.

Publicly Offered Funds

The most common are the publicly offered funds, such as the mutual funds sold through the banks and other financial services enterprises. When choosing a mutual fund to invest in, you typically look at the fund’s factsheet. This is a short document (1 to 3 pages) that tells you the strategy and investment return of this mutual fund, but it also tells you the management fee and management expense ratio, or MER, and all the other fees that may apply. Management fees are the fees charged by the fund’s investment manager and the MER includes management fees and other operating expenses such as administrative, legal and audit fees. The MER is usually in the 2-2.5% range, but it can also be as high as 3-3.5%.

Discount Brokers

If you decide to do it yourself through the discount brokers of the banks, you will be charged every time you make a transaction on the market. Typically, you would pay between $5-10 per transaction. So, when you buy shares in a company, you pay a minimum of $5 for that order, and when you sell that position, you pay another $5. Since you are now trying to survive on your own in the complexity of the stock market, you might need to buy access to more information to make better investment decisions.

This is another source of revenue for the discount brokers, because you will have to pay for this research or market data as well, and it can cost a few hundred dollars per month if you become over-exuberant and take everything they have to offer. If we look at the average behaviour of an investor, it can cost as much as a publicly offered fund.

ETFs

If you purchase exchange traded funds in your discount broker account, you will have similar but generally lower costs than those associated with the mutual funds on top of your commission. Fees, which are typically around 0.5%, are netted from the ETF’s price.

Hedge Funds

You might also have heard about the hedge funds and the stereotypical “2 and 20 fees.” The 2 means that 2% is charged in annual management fees, and the 20 is a performance fee (incentive fee). This incentive fee means they will take 20% of the return above a certain benchmark. Hedge Fund fees vary a lot, but this gives you a general idea of their fees.

Managed Accounts

You can also deal with the typical full-service stockbroker. These advisors, who manage your accounts, usually get paid through commissions, just like a real estate broker: every time you make a transaction. These commissions can range between 1 to 3% per transaction, but can also be lower. And that structure is why they might call you to trade more often than you should. Their pay is an incentive to trade.

Fee-Based Management

At Claret, we opt for another option: annual management fees charged quarterly in arrears. It might sound complex, but it’s simpler than it seems. Let’s look at an example of someone with a $100,000 portfolio, who pays 1.25% in management fees. That fee is broken down and charged every quarter. If you started the first quarter with $100,000 and made 2 percent in that quarter, you finished with $102,000. Since your fees are 1.25% for a whole year, you are only charged ¼ of that quarterly, or 0.3125%. You would think that the 0.3125% applies at the end of the quarter, but it does not. To be fair to our clients, we charge in arrears, which means we charge at the end of the quarter based on the initial value of the quarter — in this case, on the initial $100,000. So, on the first day of the second quarter, you will simply start with a little less than $102,000 (i.e. $101,687.50). This way, our clients receive our services before we get paid.

Claret Pooled Funds

We also have internal pooled funds available to our clients. Our funds allow you to achieve diversification in a cost-efficient way. Unlike mutual funds and other privately offered funds, we do not charge additional management fees, and we absorb all the administrative costs. In other words, you have the benefits of owning a fund, without the high costs.

When looking at the chart above, pay attention to the arrows and keep them in mind: paying more does not mean a better service. Of course, all investments have costs. But with the right investment strategy, you can avoid unnecessarily high costs or hidden fees eating into your returns.