The recent market volatility has probably caused quite a few headaches for some of you. If you can’t really rely on the media for reassurance, where can you find some peace of mind during market swings? In numbers, that’s where. Once again.

Here is an interesting statistic:

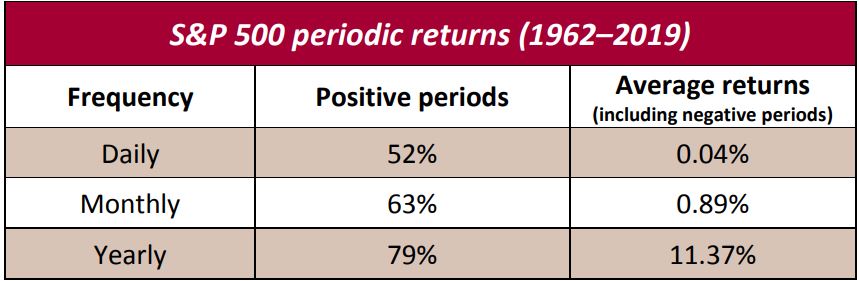

Since 1962, daily market returns have been positive only every other day or, more accurately, 52% of the time, while day-to-day performance has been zero or negative 48% of the time.

Is that enough to make money on the stock market?

Yes, for the following reasons:

- Monthly market returns are positive 63% of the time.

- Annual market returns are positive 79% of the time, or four years out of five.

- Since 1962, the average annual return on the S&P 500 has been 11.37%.

Conclusion

Over the short-term, fluctuations are both inevitable and unpredictable, yet necessary, as they create new investment opportunities. To be successful, you must therefore stay focused on the long term, choosing a consistent and disciplined approach that allows you to leave your emotions aside.

The Claret team