US markets seem to continue to climb a wall of worry driven by events around a President who is more interested in being in the news with his less than diplomatic tweeting than anything else. Sometimes, we wonder whether he is not the king of “fake news” himself… Thank God the US Constitution is written so that a single branch of government alone cannot change the country’s direction.

On the economic side, the US is chugging along around 2% real growth in GDP and employment rate is at its high. There is very little inflation thanks to new technologies that keep wages in check. For example, the presence of Amazon has made life miserable for many retailers: some of them are forced into bankruptcy while the surviving ones see their margins collapse as nobody can raise prices. Amazon has a powerful business model, so much so that new phrases have been created like “Sears is being amazoned”, or “you cannot out bezos Bezos”.

Our view has not changed: relative to the current level of interest rates, the stock market is neither cheap nor expensive. Unless one is convinced that a sharp rise in rates is around the corner, it is wise to continue investing in common equity, albeit with more selectivity and caution. At Claret, we are doing just that.

Most people believe that success in investment must come from good forecasting of the future or picking the right stocks. That is why newspapers publish a plethora of comments and advice by so-called experts, be it macro-economic or about gold, tech or any other industry.

Yet, one of the most important concepts in investments is the compounding effect of interest. So in this short letter, we would like to illustrate through some examples and charts the magic of compound interest. Albert Einstein apparently called it the eighth wonder of the world.

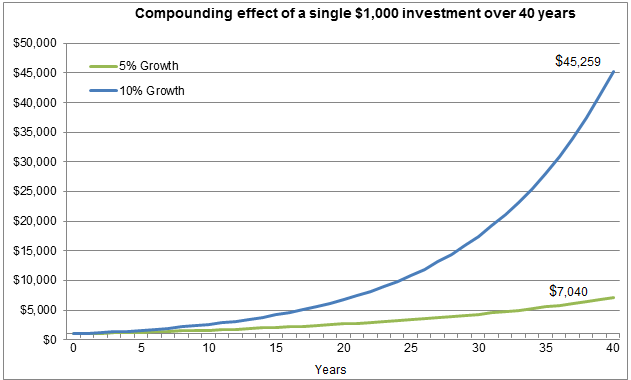

- Compounding effect of $1,000 over 40 years:

- At 5% growth rate, $1,000 will become $7,040 in 40 years (more than 700% growth);

- At 10% growth rate, $1,000 will become $45,259 in 40 years, more than 6 times the former amount (or 4500% + growth).

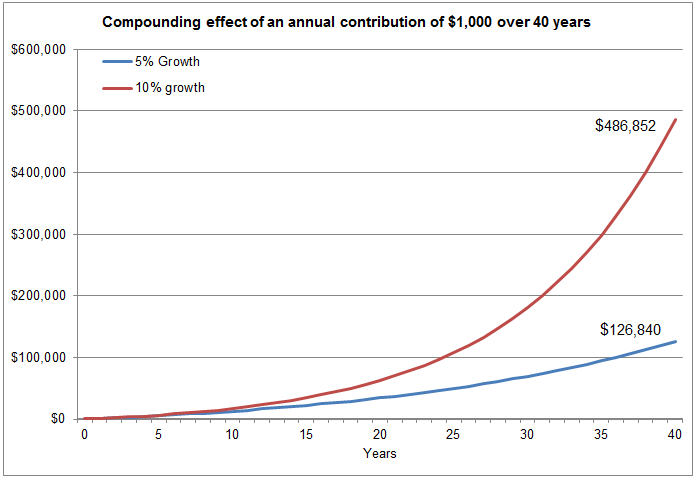

- Compounding effect of an annual contribution of $1,000 over 40 years:

- A $1,000 annual contribution to a tax-free savings account at a 5% growth rate will become $126,840 in 40 years;

- Same annual contribution at a 10% growth rate will become $486,852 in the same time.

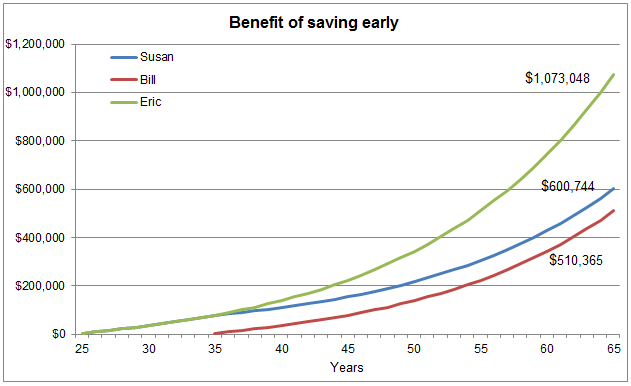

- The effect of saving early (with a 7% growth rate assumption):

- Susan invests $5,000 annually between the age of 25 and 35. Total investment: $50,000; total value at 65: $600,744.

- Bill invests $5,000 annually between the age of 35 and 65. Total investment: $150,000; total value at 65: $510,365.

- Eric invests $5,000 annually between the age of 25 and 65. Total investment: $200,000; total value at 65: $1,073,048.

- Susan, having saved for only 10 years early in her career, ends up with more wealth than Bill who saves for 30 years later in life. By starting early, Susan took advantage of the magic of compound interest. Ultimately, despite having invested less capital than Bill,

- Eric and Bill both saved $5,000 annually but Eric started 10 years early. Ultimately, Eric contributed 33% more than Bill in capital over the course of his career but ends up with double the wealth.

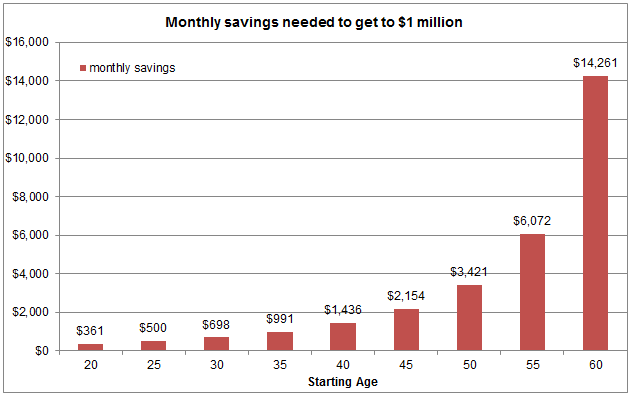

- Can anybody make a million $? Compound interest can get you pretty far. Here is a table that you can use for yourself or show to your children. Based on your age and a growth rate of 6%, it will show you how much you have to save annually in order to reach a million dollars by age 65.

In words, with a rate of 6% per year, at age 20, monthly savings of $361 are needed to get you to one million $ at age 65. At age 50, to get to 1 million, monthly savings of $3,421 are required.

Have a good summer.

The Claret Team